Games Investments Show Momentum with Q2 2024’s $3.0B and 222 Deals

Q2’s 222 Investments is Highest Investment Volume in Nearly 2 Years

H1’s $5.2B in Investments Surpasses 2023’s Annual Value of $4.5B

While the games industry goes through a tough battle of industry layoffs and business turmoil, games investments and M&As gain traction as Q2 2024 combined games investments and M&As totaled $3.8B across 262 transactions (-11% in value and +16% in volume compared to Q1’s $4.3B across 226 transactions). In addition, when comparing half-years, H1 2024’s $8.1B across 488 investments and M&As was -15% in value and +26% in volume compared to an adjusted H2 2023 $9.6B across 387 investments and M&As (excluded the outlier of Microsoft’s $68.7B acquisition of Activision Blizzard which represented 90% of H2 2023’s value).

Investments

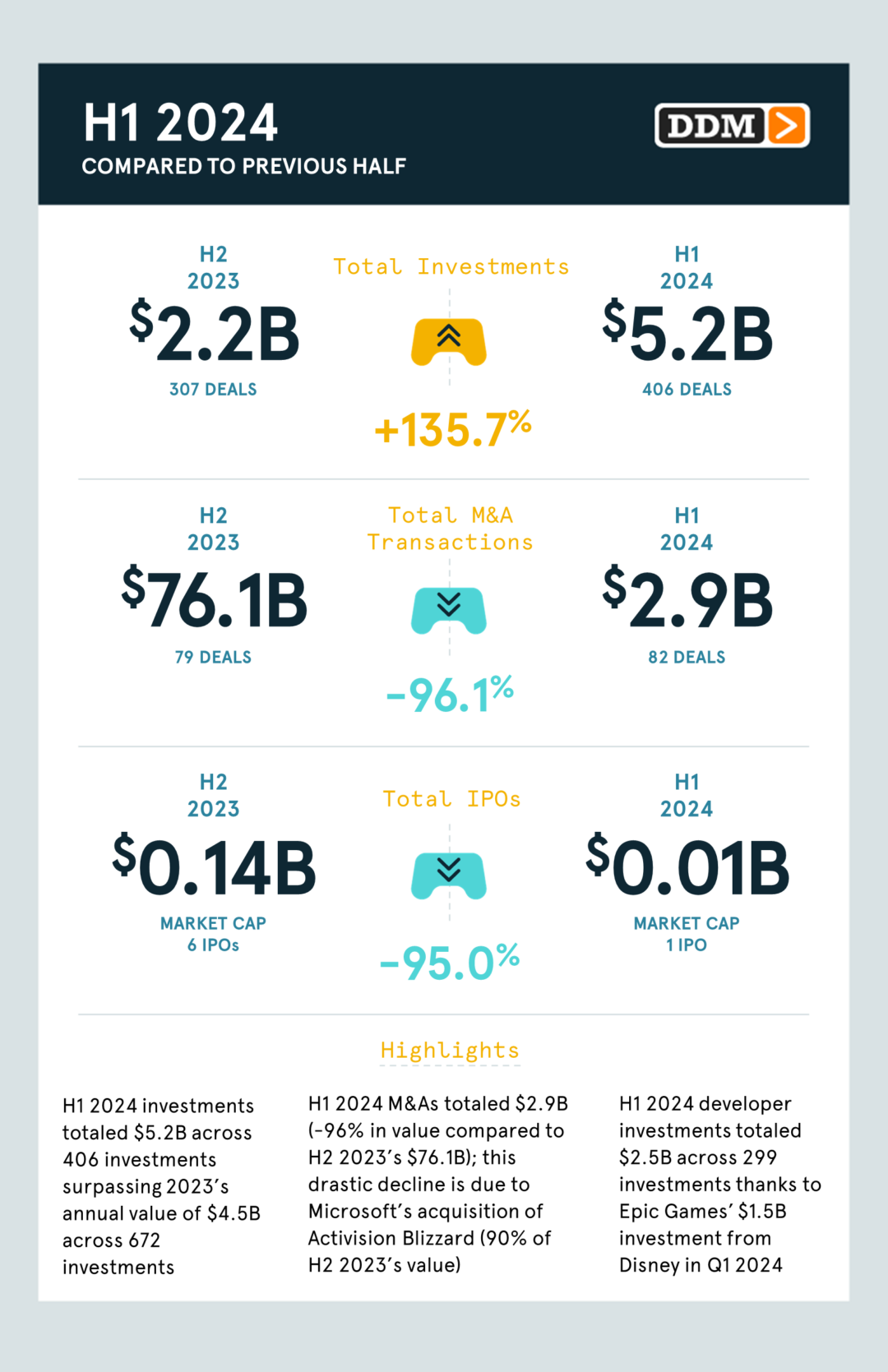

H1 2024 investments totaled $5.2B across 406 investments (+136% in value and +32% in volume over H2 2023’s $2.2B over 307 investments) passing 2023’s annual value of $4.5B across 672 investments. H1 2024’s 2.3x in value over the preceding H2 2023 is propelled by GameStop’s $2.1B post IPO equity and Epic Games’ $1.5B late-stage investments which accounted for 70% of H1 2024’s value.

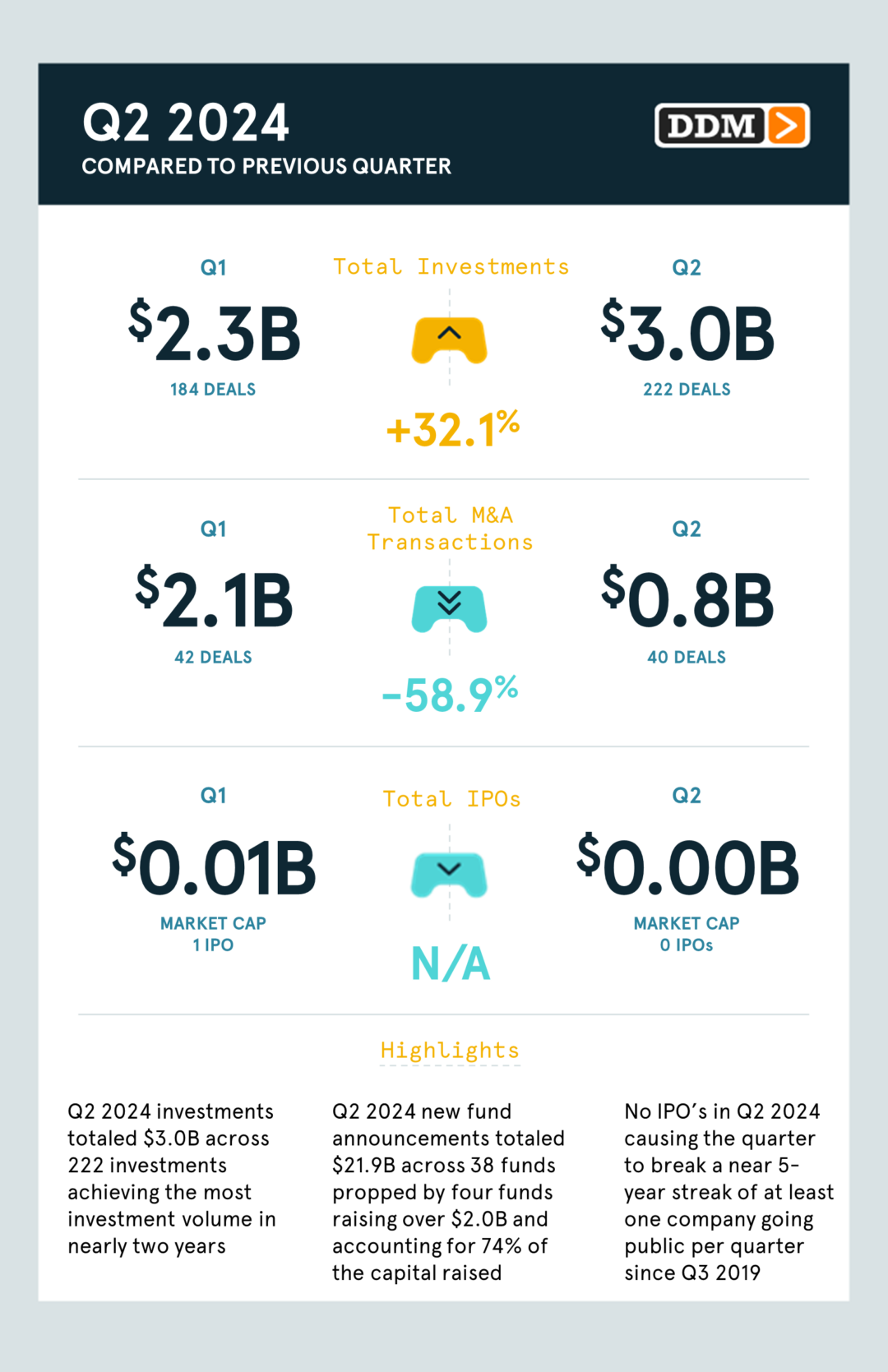

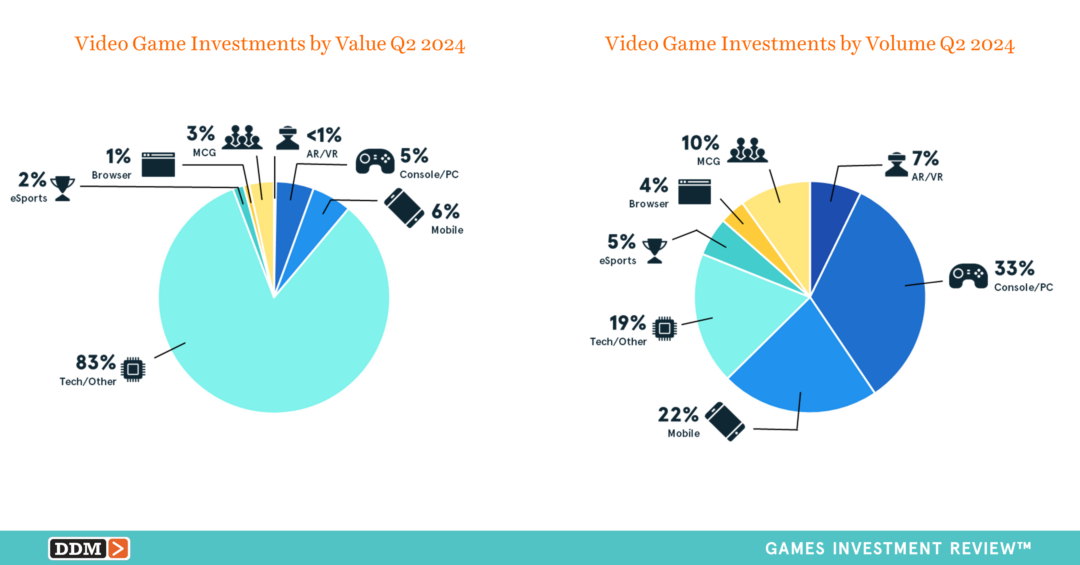

Q2 2024 investments totaled $3.0B across 222 investments (+32% in value and +21% in volume compared to Q1’s $2.3B and 184 investments) achieving the most investment volume in nearly two years as games investments have not passed 200 investments since Q3 2022. Industry segments by value and volume:

M&As

H1 2024 M&As totaled $2.9B across 82 transactions (-96% in value and +4% in volume compared to H2 2023’s $76.1B across 79 transactions) making H1 2024 a drastic decline in value due to Microsoft’s acquisition of Activision Blizzard (90% of H2 2023’s value).

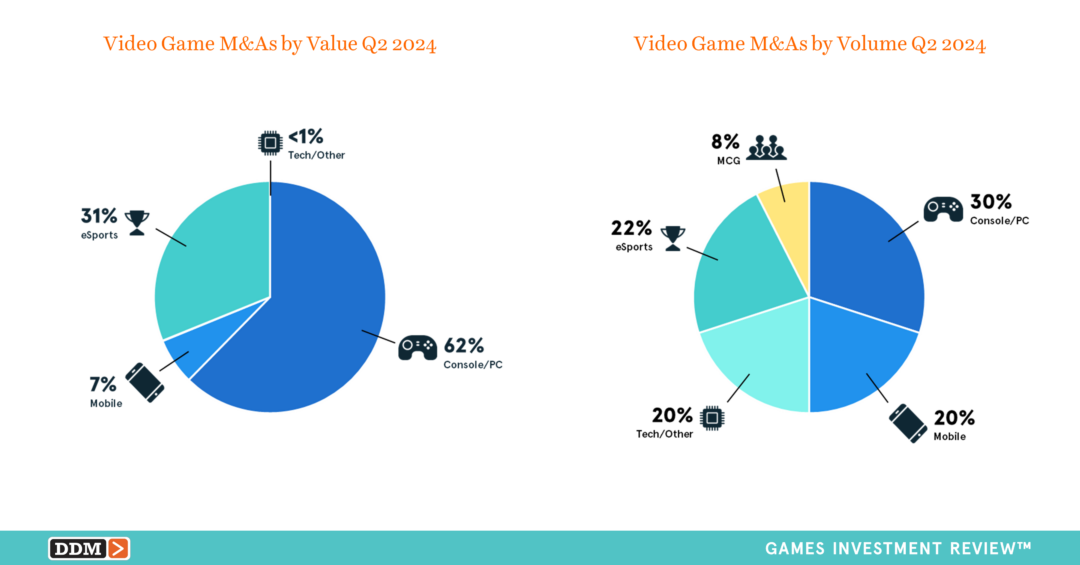

Q2 2024 M&As totaled $845.0M across 40 transactions (-59% in value and -5% in volume over Q1’s $2.1B across 43 transactions). M&A deal volume marginally declined quarter-over-quarter since Q4 2023’s 45 transactions. Q2 2024’s M&A lower total value can be attributed to the lack of large transactions which inflated previous quarters. Industry segments by value and volume:

H1 2024 has been light on public debuts with one IPO at $7.2M (-95% in value and -83% in volume), the lowest volume since H1 2019 which also had one IPO. There were no IPO’s in Q2 2024 causing the quarter to break a near 5-year streak of at least one company going public per quarter since Q3 2019 when DouYu debuted with a $3.7B market capitalization.

New Fund Announcements

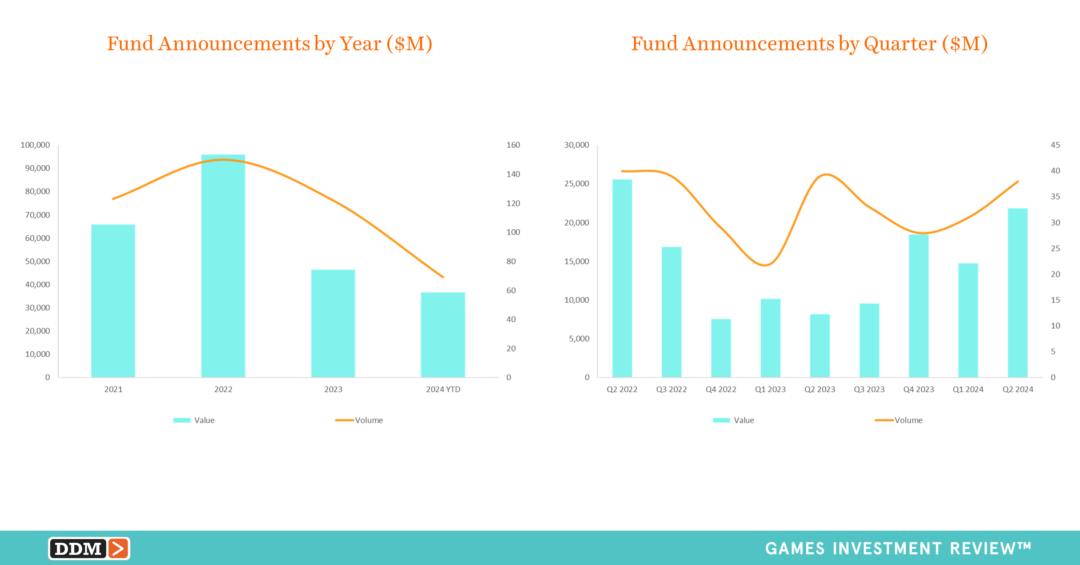

H1 2024 new fund announcements totaled $36.7B in new capital raised across 69 funds (+31% in value and +13% in volume compared to H2 2023 totaling $28.0B across 61 funds) continuing an uptrend of capital raised per half-year since H1 2023 which totaled $18.3B across 61 funds (+100% in value and +13% in volume).

Q2 2024 new fund announcements totaled $21.9B across 38 funds (+48% in value and +23% in volume compared to Q1 2024’s $14.8B across 31 funds) driven by four funds raising over $2.0B accounting for 74% of the capital raised for the quarter. In Q2 2024 artificial intelligence was a major focus as funds interested in AI raised $4.3B across 11 funds (-50% in value and +57% in volume compared to Q1 2024’s $8.5B across 7 funds with an AI interest).

Read more in our Q2/H1 2024 Games Investment Executive Summary or purchase the Transaction Bundle for $399, which contains the full listing of investments, M&As, and IPOs from the quarter in a PDF and Excel file format. We have greatly expanded the content within developers, blockchain, and industry segments by releasing individual content drops throughout the year. These drops and additional data charts from our Games Investment Review reports can also be found on our website at DDMGamesInvestmentReview.com. We always welcome your feedback at data@ddmagents.com. Follow us at Digital Development Management on LinkedIn for our additional insights or sign up for our newsletter on our website.