$51.5 Billion Over 1,182 Transactions: 2022 is the Second-Best Year for Gaming Investments/M&As

Q4 2022 Games Investment Review Report Available

By the DDM Data & Research Team

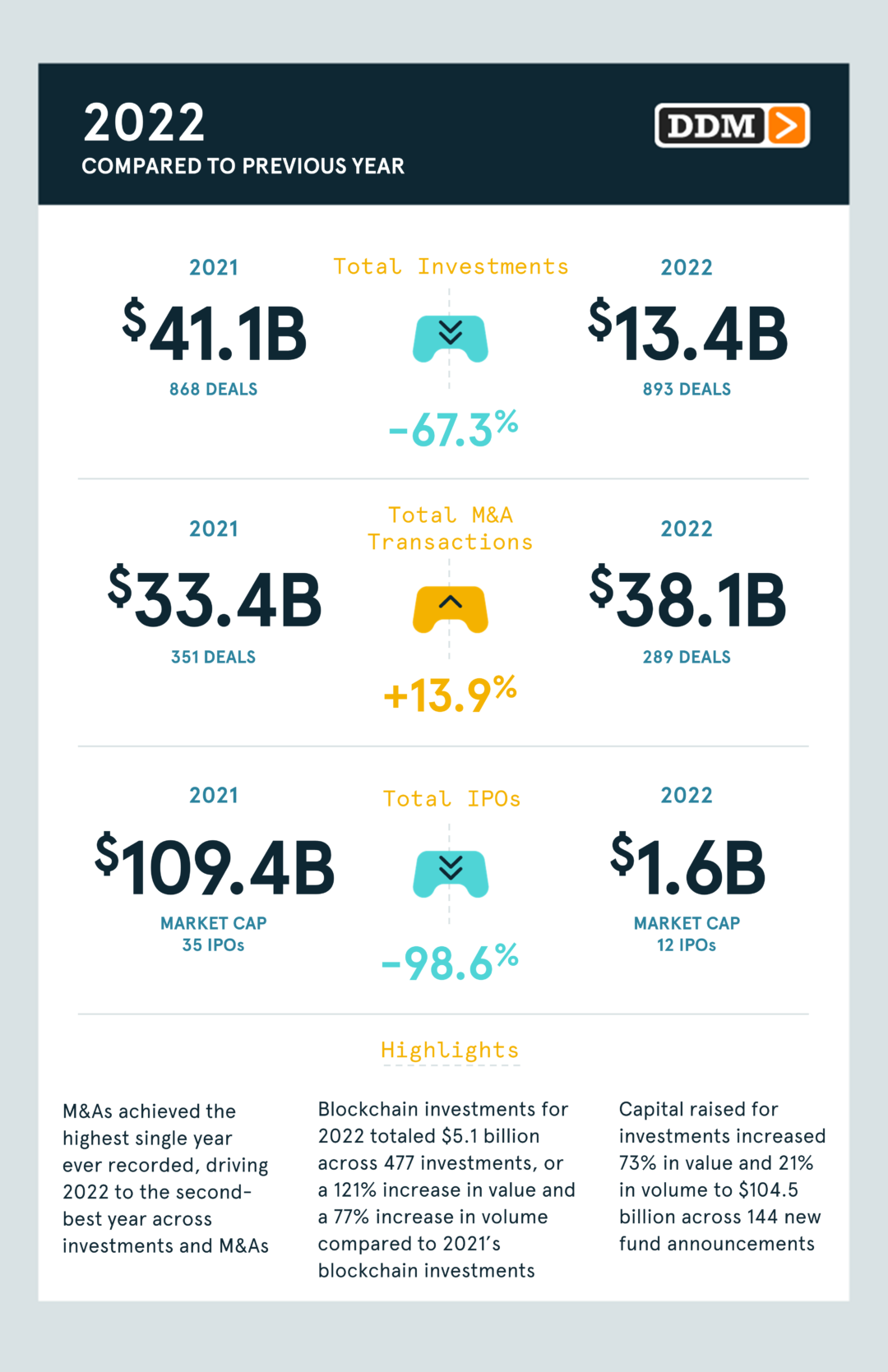

It may not have been 2021’s record breaking year, but with all the challenges that plagued the industry, 2022 wasn’t just a great year, it was an incredible year. For instance, 2022 amounted to the second-best year in games investments and M&As which totaled $51.5 billion over 1,182 transactions. DDM admits it may not be as eye-popping or “record breaking” as 2021’s $74.5 billion across 1,219 transactions, but 2022 gave us a lot of surprising moments, showing that 2023 could reach new heights which may not be broken for decades to come. So, what happened over the last two years that could lead to this? Let’s take a look:

2021 represented a “rising tide lifts all boats” effect where an economic bull run mixed with cash heavy strategic and financial firms and angels ignited investments, acquisitions, and IPOs. To recap 2021:

- Investments from 2020 to 2021 more-than tripled in value ($13.5 billion to $41.0 billion) and nearly doubled in volume (489 to 868)

- M&As nearly tripled in value ($12.0 billion to $33.4 billion) and reached 1.5x in volume (234 to 351)

- IPOs outpaced both investments and M&As with total market capitalizations increasing more than 5x in value ($20.6 billion to $109.4 billion) and 3x in volume (10 to 35)

- New funds in 2021 with capital to deploy as investments amounted to $60.2 billion over 119 announcements

However, the investment landscape in 2022 has been hindered by a crypto winter, macroeconomic headwinds, high interest rates and inflation, and recession concerns. Despite these challenges, our data shows that 2022 was still the second-best year in the video game industry for games funding, mainly driven by acquisitions as large gaming corporations acquire mature and established businesses.

- The combined value of investments and M&As for 2022 totaling $51.5 billion over 1,182 transactions is the second-best year compared to 2021’s $74.5 billion across 1,219 transactions

- Investments amounted to $13.4 billion over 893 transactions, which is the third-best year coming up short to 2020’s $13.5 billion across 489 investments

- M&As achieved the highest single year ever recorded totaling $38.1 billion across 289 transactions, driving 2022 to the second-best year across all games investments and M&A transactions

- Twelve companies held IPOs resulting in the third highest year in volume, just shy of 2020’s thirteen IPOs

- New fund announcements in 2022 increased 73% in capital raised and 21% in volume year-over year at $104.5 billion across 144 announcements

Due to the macroeconomic headwinds and other obstacles the industry is currently facing, the growth across investments, acquisitions, and IPOs have slowed, but there is still foundation for a strong 2023. For instance, last January Microsoft announced the intention of acquiring Activision Blizzard for $68.7 billion which would not only be the biggest gaming deal ever, but it would also beat every year besides 2021’s “record breaking” year by value, in one transaction alone. It is worth noting that this transaction is still subject to regulatory approval and is hitting some hurdles along the way as it is currently under investigation in the EU, UK, and US. This is in addition to the consolidating market path that has continued throughout the industry each year. Nevertheless, DDM believes 2023 is shaping to be another good year for gaming investments, acquisitions, and IPOs, but industry growth will be hampered until macroeconomic pressures ease.

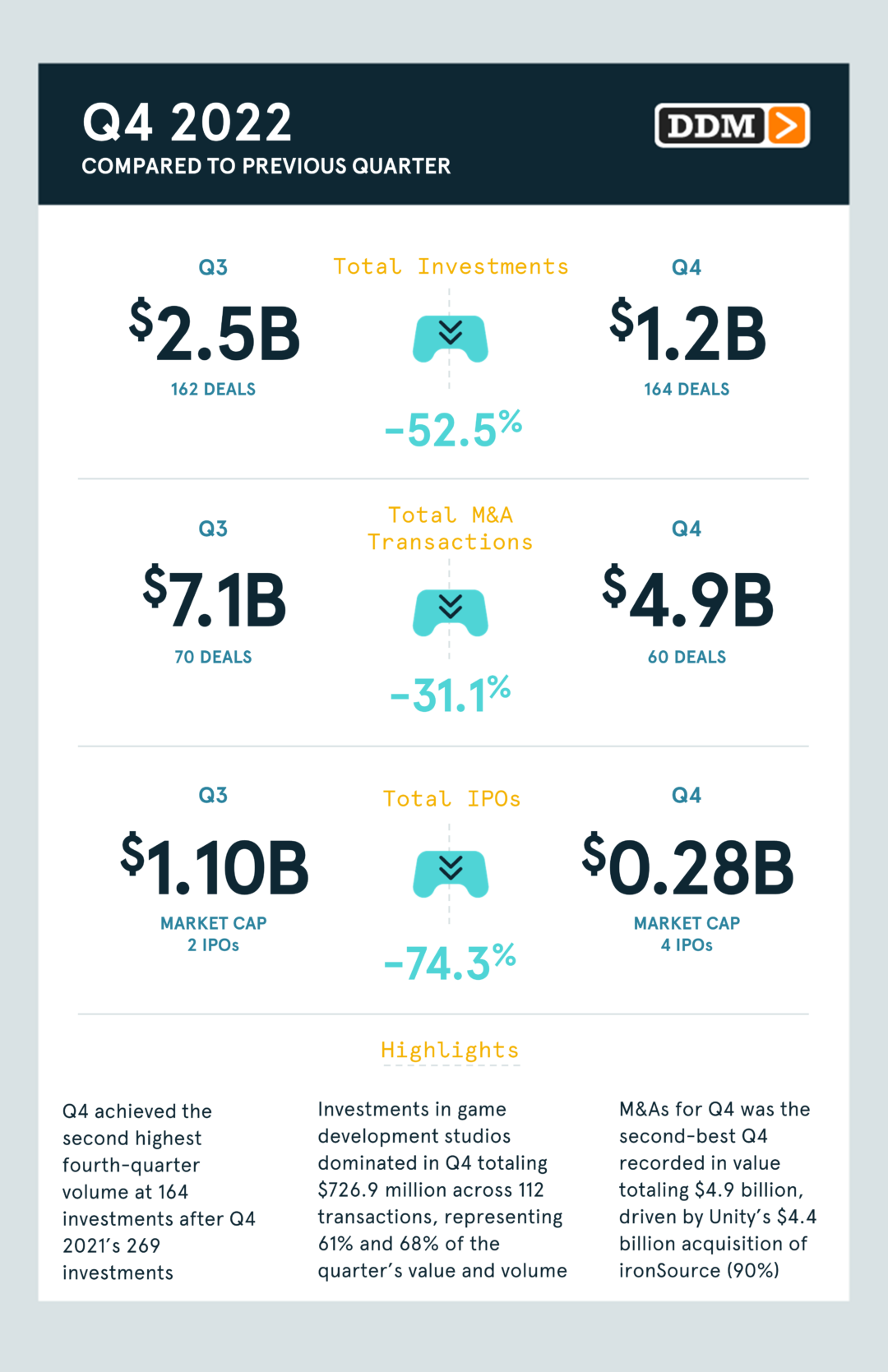

Macroeconomic challenges throughout the year continued to inhibit investments, acquisitions, and IPOs for Q4.

- Investments amounted to $1.2 billion across 164 investments, a decrease of 53% in value and an increase of 1% in volume compared to Q3’s $2.5 billion across 162 investments

- M&As reached $4.9 billion across 60 transactions, a 31% decline in value and 14% in volume, compared to Q3’s $7.1 billion across 70 transactions

- The $4.4 billion acquisition of ironSource by Unity represented 90% of Q4’s M&A value of $4.9 billion

- Four companies held IPOs in Q4 with a total market capitalization of $283 million or a 290% decrease in value and 100% increase in volume compared to Q3’s two IPOs at a total market capitalization of $1.1 billion which was primarily due to Technicolor Creative Studios $1.0 billion IPO (93%)

To continue reading our free Q4 2022 report, click here.

—

The DDM Games Investment Review Q4 2022 report is now available for purchase: $399 per single quarter or $999 for an annual subscription. In addition to our industry forecast, the report contains a complete list of investment/M&A transactions from the quarter as well as expanded lists of the quarter’s top transactions and investors. For more information about our quarterly reports or the DDM Games Investment Review, visit www.ddmgamesinvestmentreview.com or email data@ddmagents.com.

Follow the DDM Games Investment Review on Twitter at @gamesinvestment.