2024 Ends as a Strong Year with $17.5B Across 985 Investments/M&As

Q4’s $6.0B Across Investments/M&As was the Largest Quarter in 2024

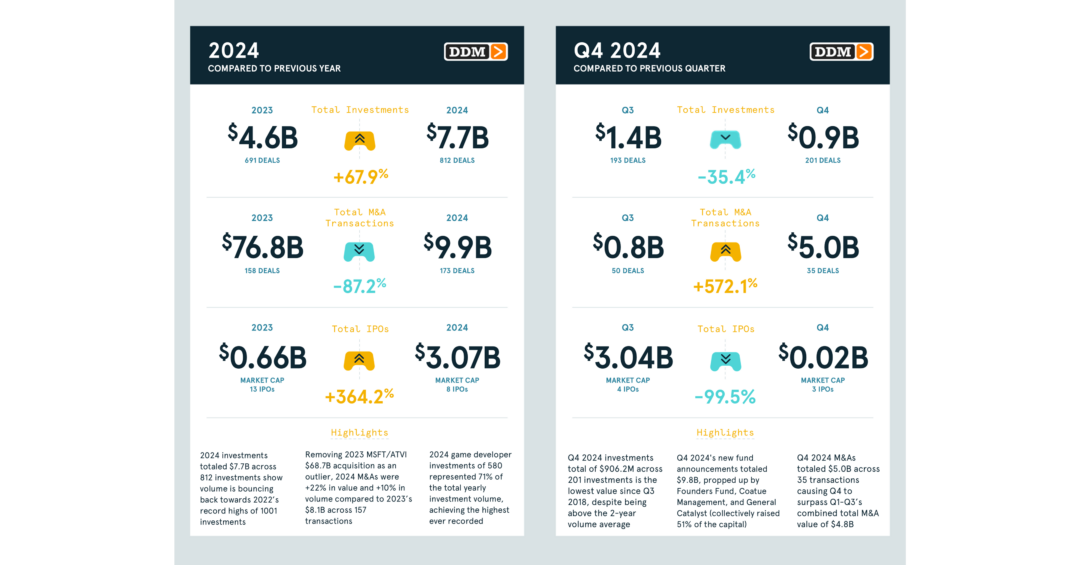

As the games industry moves on from chapter “survive til 25,” 2024 games investment and M&A data reveals recovery and improvement. In order to properly compare 2024 to 2023, it’s important to remember that in Q4 2023 Microsoft acquired Activision Blizzard for $68.7B, the largest gaming M&A in history by over 5.4x its nearest counterpart of Take-Two Interactive’s $12.7B acquisition of Zynga. Removing Microsoft’s acquisition as an outlier, 2024 was a stronger year totaling $17.5B across 985 in combined investments and M&As (+39% in value and +16% in volume compared to 2023’s $12.6B across 848 investments and M&As). This is particularly evident by dissecting 2024 in totality.

Investments

2024 investments totaled $7.7B across 812 investments (+68% in value and +18% in volume over 2023’s $4.6B over 691 investments). Although investment values are -81% from 2021’s $41.4B, volume is bouncing back towards 2022’s record highs of 1001 investments.

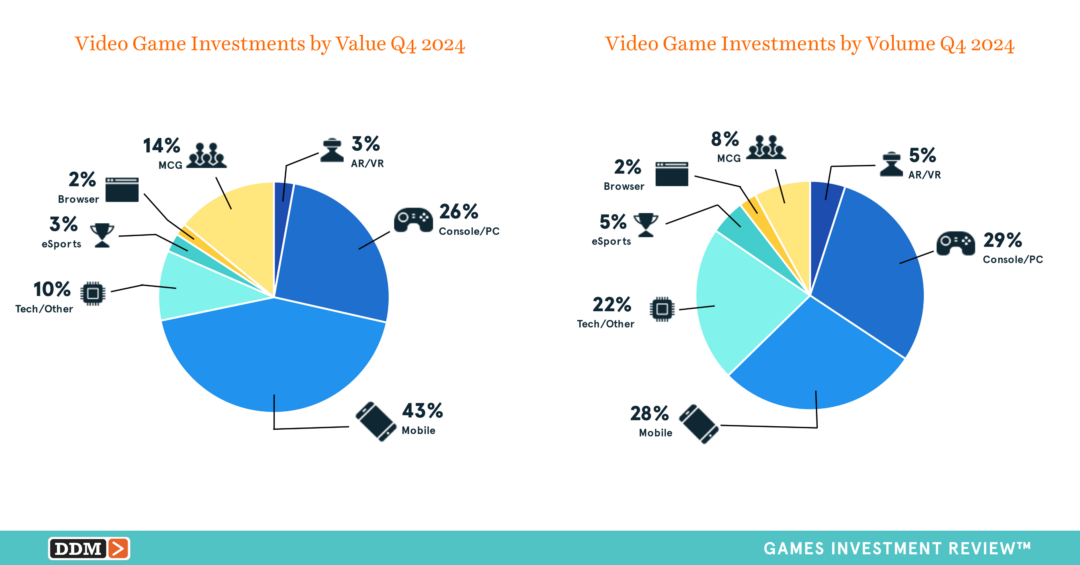

Q4 2024 investments totaled $906.2M across 201 investments (-35% in value and +4% in volume compared to Q3’s $1.4B and 193 investments) recording the lowest value since Q3 2018 of $650.6M. Investment values were dampened, with early-stage investments representing the majority (66% by value), while volume remained strong as Q4 was +7% above the 2-year quarterly average of 187 investments. Industry segments by value and volume:

M&As

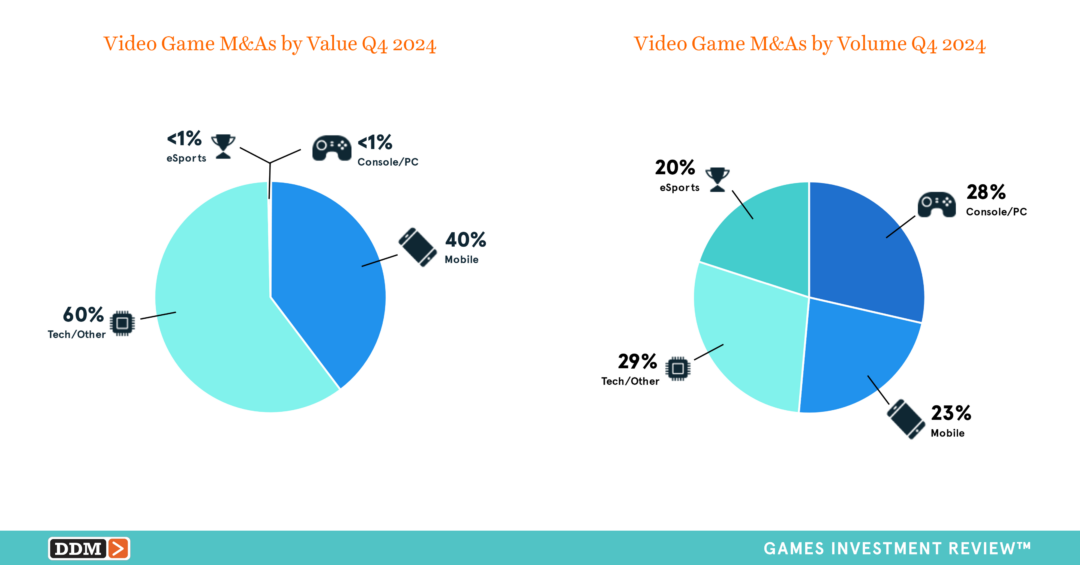

2024 M&As totaled $9.9B across 173 transactions (-87% in value and +10% in volume compared to 2023’s $76.8B across 158 transactions). 2024’s sharp decrease in M&A value is from Microsoft’s colossal $68.7B acquisition of Activision Blizzard (90% of 2023’s M&A value) and if removed as an outlier, 2023 M&As would have totaled $8.1B across 157 transactions, resulting in 2024’s M&A value to be +22% of 2023.

Q4 2024 M&As totaled $5.0B across 35 transactions (+566% in value and -30% in volume compared to Q3’s $751.1M across 50 transactions), surpassing the combined total M&A value of $4.8B from Q1-Q3. Q4’s M&As were propped by EQT Groups and others’ $2.7B acquisition of Keywords Studios and Playtika’s $2.0B acquisition of Superplay (94% of the total M&A value). Industry segments by value and volume:

New Fund Announcements

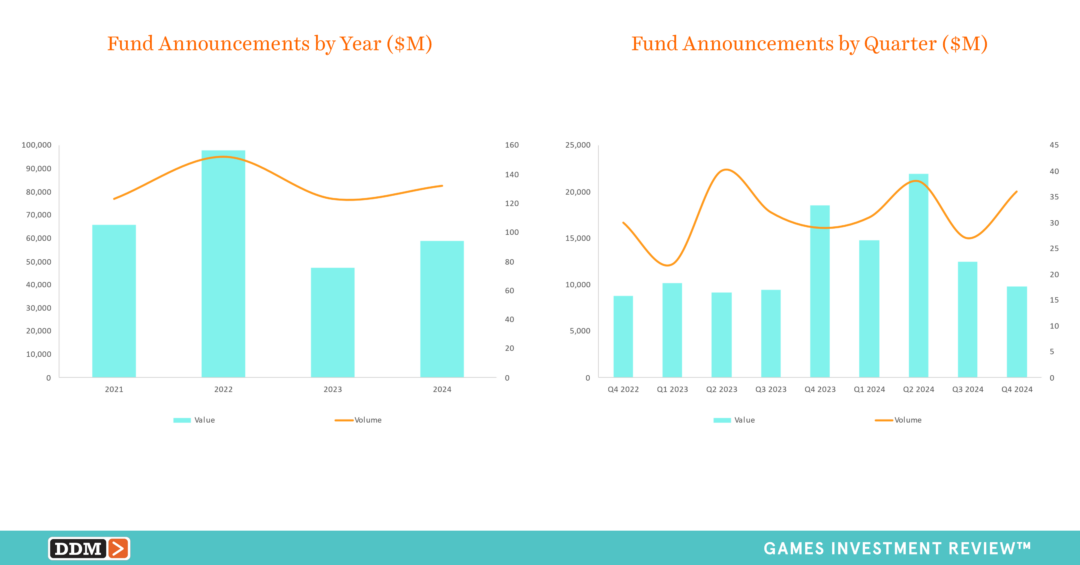

2024 new fund announcements totaled $58.9B in new capital raised across 132 funds (+25% in value and +7% in volume compared to 2023 totaling $47.2B across 123 funds).

Q4 2024’s new fund announcements totaled $9.8B across 36 funds (-21% in value and +33% in volume compared to Q3 2024’s $12.4B across 27 funds). Q4’s funding was driven by three funds collectively raising over $5.0B (51% of the capital raised): Founders Fund ($3.0B), Coatue Management ($1.0B), and General Catalyst ($1.0B). New fund announcements by value and volume:

Read more in our Q4 2024 Games Investment Executive Summary or purchase the Transaction Bundle for $399, which contains the full listing of investments, M&As, and IPOs from the quarter in a PDF and Excel file format. We have greatly expanded the content within developers, Console/PC, and mobile industry segments by releasing individual content drops throughout the year. These drops and additional data charts from our Games Investment Review reports can also be found on our website at DDMGamesInvestmentReview.com. We always welcome your feedback at data@ddmagents.com. Follow us at Digital Development Management on LinkedIn for our additional insights or sign up for our newsletter on our website.