2024 Investment and M&A Highlights

In 2024, the investment and M&A news reflected the current market and events within the video games industry. As we near the close of 2024, we have put together a list (in no particular order) of some of the top highlights the industry has navigated.

Post-COVID normalcy mixed with macroeconomic headwinds brings record layoffs, closures, and divestitures. While the pandemic brought in record revenues and profits for game makers, the opposite was true as the gaming industry pulled back from macroeconomic headwinds and post-pandemic normalcy causing over 14,000 layoffs and record high closures and divestitures. As the industry transitioned to “survive til’ 25” gaming giants like Embracer Group, Gamer Network, Thunderful Group, and Zynga have offloaded businesses that were not in line with their core offering.

Public gaming companies are now considering going private. As development budgets inflate and companies fail to meet shareholder expectations, public gaming companies are going private to access more capital and focus on long-term goals with additional expertise. Top examples in 2024 include Kahoot! and Keywords Studios. Assassin’s Creed publisher Ubisoft, whose share price dropped 58%, is speculated that its owners may join with Chinese gaming giant Tencent and take the company private.

Embracer Group and its subsidiaries have a turbulent 2024 by reducing debt and finding stability. Between 2020 and 2022, the Embracer Group acquired 60 developers, small publishers, and service providers in addition to a number of industry-adjacent companies like board game behemoth Asmodee and Lord of the Rings IP holder Middle-earth Enterprises. After failing to secure a $2B investment reportedly from Saudi Arabia’s Savvy Group in 2023, the company started a restructure program in June 2023 that included 80 project cancellations, 44 studio closures, and 4,500 layoffs. After a number of divestments in 2024, including high profile studio Saber Interactive and ending with Gearbox Entertainment (approximately 50% and 30% of their original considerations, respectively), Embracer Group declared their restructuring program was concluded in March 2024 and that “it’s way too early to start talking about restarting the M&A engines again.” Embracer Group has further enacted to reduce its debt and financial leverage with a revolving credit facility, issuing €940M in senior secured notes, divesting mobile games developer Easybrain for $1.2B next year, and an upcoming 2025 split into three entities (Asmodee Group, Coffee Stain & Friends, Middle-earth Enterprises & Friends).

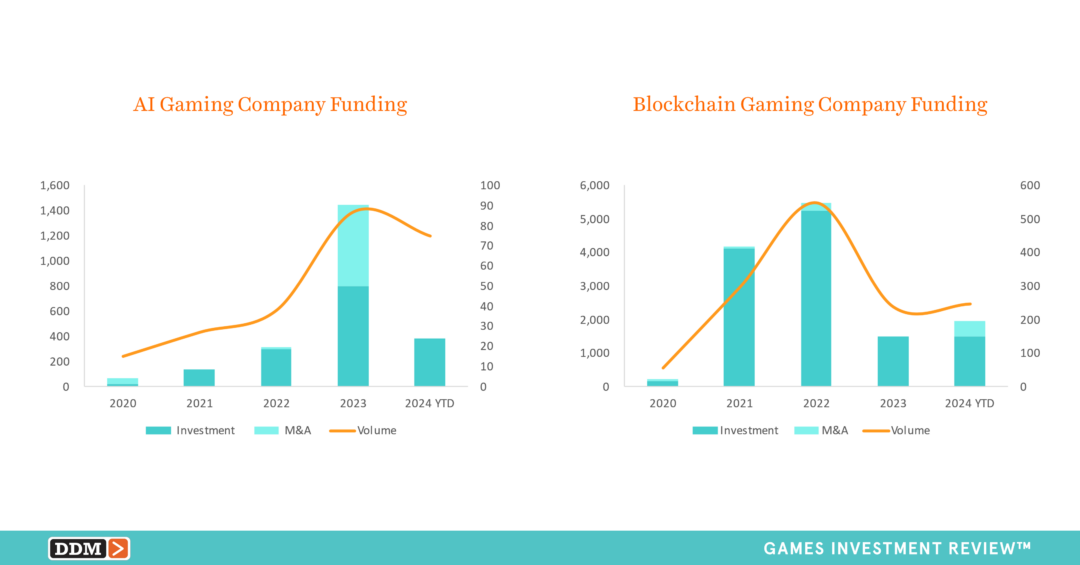

While AI has replaced blockchain as the latest “shiny” technology, AI within the video game industry has not received the same amount of interest from investors and acquirers. During the pandemic years, investors and acquirers accelerated blockchain games investments and M&As to a combined $4.2B across 222 transactions (an 18x in value and 5x in volume compared to 2020’s $222.3M across 54 transactions). However, hampered by regulations, concerns of legalities, and the lack of investment and M&A activity, AI gaming has been slower to gain momentum. AI game companies have only achieved $2.3B across 228 transactions over the last 5 years (2019-2024 YTD). AI cloud provider Gcore received $60M Series A, the highest investment for an AI gaming company YTD in 2024. While there have only been a few M&As, such as AI eSports coaching platform iTero Gaming, all were with undisclosed deal terms.

The next frontier for XR games funding may be mixed reality. When Meta teased its advanced AR glasses dubbed “Orion” and Apple released its Vision Pro headset earlier this year, they demonstrated that big tech is still investing and expanding the possibilities of XR hardware and use of spatial computing. XR games investment and M&As have primarily focused on AR and VR; however, this year, Eggscape Entertainment and MixRift, two mixed reality game developers, received early-stage investments.

User-Generated Content (UGC) is attracting investment interest with prominent UGC game platform Roblox’s share price recovering from questions around its business practices. Hindenburg Research’s piece on Roblox called into question the safety of children on the platform and alleged that Roblox inflated performance metrics. In response to the report, Roblox stock dropped 9%, but has since rebounded. Additionally, there were a number of UGC companies taking investment this year. Build A Rocket Boy raised a Series D round of over $110M, which in part will be used to launch its UGC toolset Arcadia. Several UGC games developers raised funding including Astra Nova, Iconic Arts, RIVRS and Smokespot Games. Other UGC service providers also raised capital including AI-powered UGC games engine provider Arcane, blockchain UGC games discovery platform provider SlingShot DAO, and UGC platform provider Megamod.

Poland continues to lead the world in gaming companies going public although the market prices of such companies have been rocky in recent months. Polish game companies had 40 IPOs since 2020, 4x the United States, the nearest country at 10 IPOs. Most of these companies have been small game developers and have debuted on the NewConnect Exchange. This year, six Polish gaming companies went public on NewConnect, including ConsoleWay, Dark Point Games, G-DEVS, GameHunters, Lichthund, and Madnetic Games. As typical with Polish companies going public, most of the companies had a strong focus on PC game development and have small market capitalizations, which in 2024 ranged between $1.8M-$17.8M. The largest capitalization was from GameHunters at $17.8M.

The Indian video game market is fast-growing and Nazara Technologies is at the forefront. A report from Indian investment firm Lumikai cites gaming as 30% or $3.8B of the country’s $12.5B new media market with 591M active gamers. Gaming is the fastest growing segment with a 20% 5-year CAGR. Nazara Technologies, along with its subsidiary Nodwin Gaming, belongs to a small group of companies like Tencent and Keywords that have made names for themselves for their active investments or acquisitions. To date in 2024, Nazara has spent over $120M to invest or acquire 10 mobile and eSports gaming companies including Freaks 4U Gaming, Fusebox Games, and Paper Boat Apps. They have raised $110M in post-IPO equity to fuel their war chest and divested assets such as NZMobile Kenya. From its initial focus on India, Nazara is now looking globally in order to grow from $100M to $10B valuation.

Saudi Arabia has actively created partnerships with fewer game investments and M&As, but a “megadeal” is coming soon. 2024 has been a quiet year for games investments and M&As within Saudi Arabia after Saavy Games Group announced they still have 75% of the $38.0B video game hub initiative, even after the $4.9B acquisition of Scopely. However, that’s not to say that the region has not been active as they held the first Esports World Cup, announced more initiatives, and signed a long line of partnerships with Animoca Brands, China Media Group, Japan, MOONTON Games, Niantic, Qiddiya City, and Sony. Additionally, Scopley’s Tim O’Brian announced the mobile developer is eyeing a “megadeal” within 2025.

Chinese gaming giants’ investments and M&As in Western companies slowed in 2024. Although gaming giants like Tencent and NetEase have announced M&A growth strategies through Western countries, their activity has diminished with NetEase focusing more on opening studios in the West such as BulletFarm. YTD NetEase (Blue Scarab Entertainment, Build A Rocket Boy) and Tencent (Futur Lab, and Remedy Entertainment) have only invested in and acquired two Western companies in 2024.

Blockchain survives the “crypto winter” boosting blockchain games investments from improved market conditions. The “Crypto Winter” came to an end as many positive events sent Bitcoin soaring from $45K to $100K in less than a year. Some events include: the SEC approving 11 Bitcoin and 8 Ethereum SPOT ETFs, the bitcoin halving, the Federal Reserve cutting interest rates, and a crypto-friendly Donald Trump winning the 2024 presidential election. Due to Bitcoin’s run-up, more liquidity flooded the market giving blockchain games a “rising tide lifts all boats” effect as YTD blockchain game investments have totaled $1.9B across 236 (+64% in value and +30% in volume compared to 2023’s $1.5B across 181 investments). DDM has also seen a few gaming companies such as Microsoft and Boyaa Interactive contemplate or invest in Bitcoin directly.

Incubators and accelerators continue to be a resource for early-stage game studios and emerging technology. As mentioned in last year’s highlights, DDM has seen an uptick in incubators and accelerators which can be a source for games funding. In 2024, new incubators and accelerators came to fruition including: Game IP Incubation Program, House of Creators, Helika Accelerate Indie Game Monetization Accelerator, Multiplayer Fellowship, Narwhal Accelerator, and Saakuru Labs Incubation Fund.

More countries are using tax incentives and grants to boost their video game industries. Canada and the UK have long offered tax incentives and grants to video game companies; Italy and Ireland enacted programs in 2021 and 2022, respectively. The UK government reported it paid £1.48B to British video game companies while trade association TIGA announced a manifesto to grow their industry. Türkiye offers generous incentives that include no tax on studio profits, income tax exemption for developers, no capital gains tax, 50% salary to $50K for two people, and platform fee reimbursed 50% up to $100K. Last year, Australia launched new initiatives and this year, New Zealand voted to continue their program. Germany announced a new funding program to combat its declining rate of video game studio startups. Denmark formed its first video game association, Games Denmark, to double its industry and established a games institute that will be responsible for public funds distribution. Upcoming programs include the Czech Republic which may include video games for state-supported grants. Brazil signed into a law a new legal framework for the video games industry to define the industry, fund and offer tax incentives, and boost IP protections. South Korea announced a five-year plan to grow its share of the console games market from its current 1.5% share and diversify from mobile and PC online games. There’s an “arms race” in countries boosting their video game industry with more potentially coming from South America and Southeast Asia as firms move from providing services to producing their own IP.

The eSports winter brought a blizzard of industry change leading to layoffs, divestitures, pivots, and consolidations. YTD eSports M&As totaled 35 transactions compared to 2023’s Q1-Q3 24 transactions. The most notable distressed transaction was the sale of FaZe Clan to GameSquare Holdings for $15.8M. This represents a more than 97% loss in value since July of 2022, when FaZe Clan went public via a SPAC for $725M. Subsequently, FaZe Clan spun out non-eSports assets into FaZe Media. DCB acquired Guild Esports for £100K and £2m in liabilities. Guild Esports had an IPO in 2020 for $25.8M. Other distressed companies that sold assets include Esportal, Stryda, and MNM Gaming.

Blockchain TON-based gaming is rising on social media platform Telegram. While it’s been common to see social media platforms like Facebook and WeChat be a destinations for games, Telegram, the instant messaging and social media platform, has become an attractive platform for TON-based blockchain games. So much in-fact, DDM has seen a substantial amount of Telegram-based game studios receive investments including Gamee, Kokomo Games, MiniTon, Pixelverse, Pluto Studio, Roolz, SODA, and Televerse.

Apple and Google being forced to allow 3rd party app stores brings more game storefronts and investments. Since 2020, Apple and Google have been a part of an ongoing legal battle with Epic Games who claimed they monopolized their phone app stores. While it would be exhaustive to go over every investigation and the formalities of each case, the cliff notes are that the walls are starting to come down from Apple and Google. The recent changes in app store guidelines have brought in an influx of store fronts and investments including AltStore PAL, Anstream, Aptoide, Dotplay, Epic Games, Microsoft, Neon, Now.gg, ONE STORE, and Skich.

Games mainstream success across transmedia brings in investments for proven IPs. While video game adaptations brought in a 109% increase year-over-year to $712.0M in 2023 ticket sales and the success of hit TV shows Fallout and the Last of Us, DDM has seen a rise of investments for transmedia collaborations including Epic Games’ $1.5B investment from Disney so their universes, characters, and stories can be playable through Fortnite.

—

Download our free Q3 2024 Games Investment Executive Summary or purchase the standalone single report with quarterly transaction tables and data for $399. On our Reports page, we also offer our quarterly business outlook for Project & Studio Financing as well as standalone segment reports on Mobile, Console/PC, and Developer funding.

Sign up for the Games Investment Review newsletter or view additional data charts and tables from our Games Investment Review reports on our website at DDMGamesInvestmentReview.com.

We always welcome your feedback at data@ddmagents.com.

Wishing everyone a safe and happy holiday season–we look forward to a bright 2025! ✨