2024’s YTD $10.4B Investments/M&As Already a Stronger Year than 2023

Q3 Dampened by Lower Values, While Volume for M&As and IPOs Improved

With three quarters down and one to go, 2024 has been on par for games investments and M&As totaling $10.38B across 726 transactions (+<1% in value compared to 2023’s Q1-Q3’s $10.36B). However, from the increased volume across investments and M&As (2024 YTD’s 726 transactions or +16% in volume compared to 2023’s Q1-Q3’s 632 transactions), the games industry shows signs of recovery from a troubled past two years.

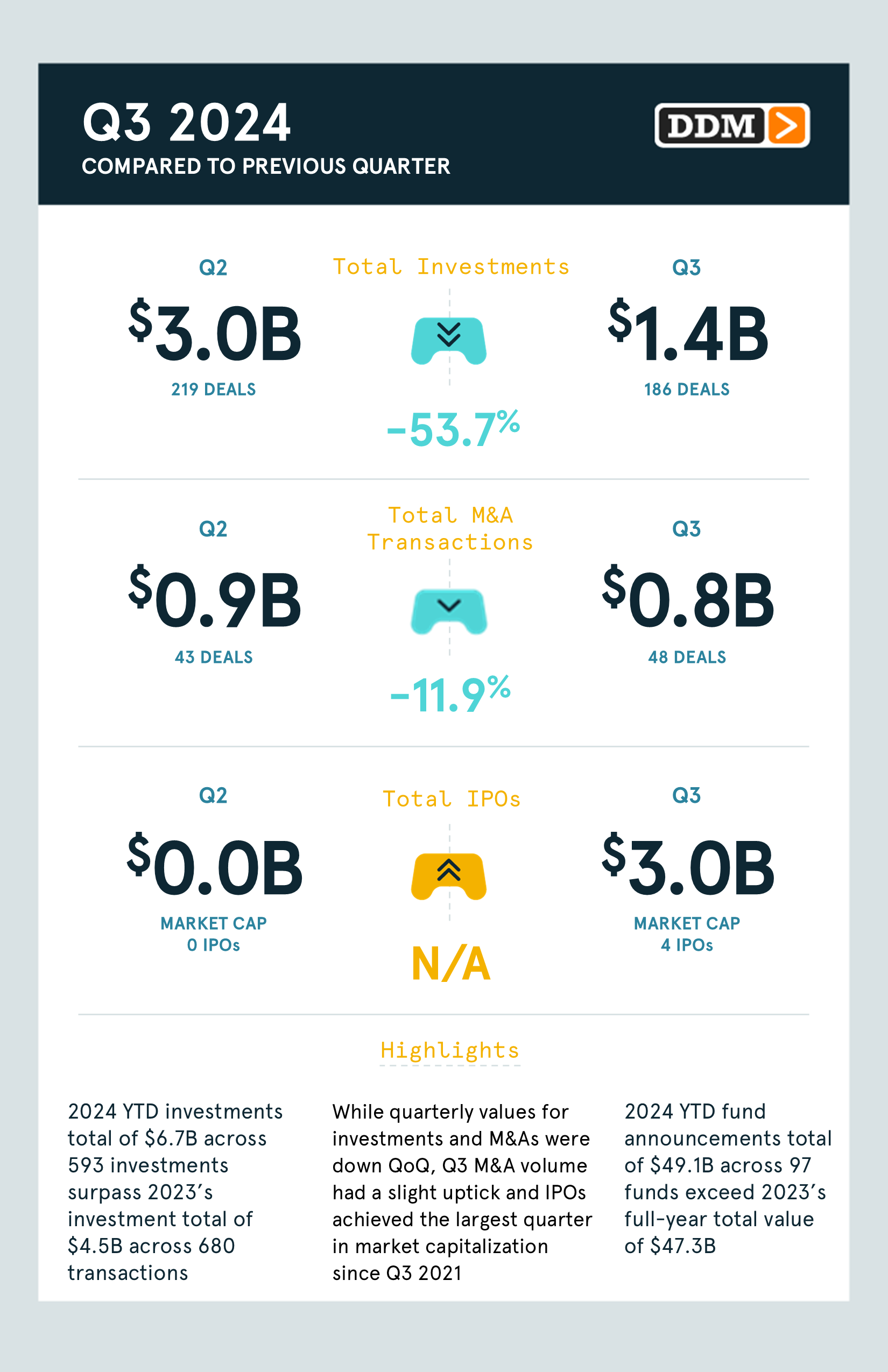

Q3 itself was significantly lower than either quarter of the year as combined game investments and M&As totaled $2.2B across 234 transactions (-44% in value and 11% in volume compared to Q2’s $3.9B across 262 transactions). While Q3 was dampened by lower values, M&As and IPOs saw improvement by volume. Despite the slight regression in Q3, 2024 has already been a slightly stronger year than 2023.

Investments

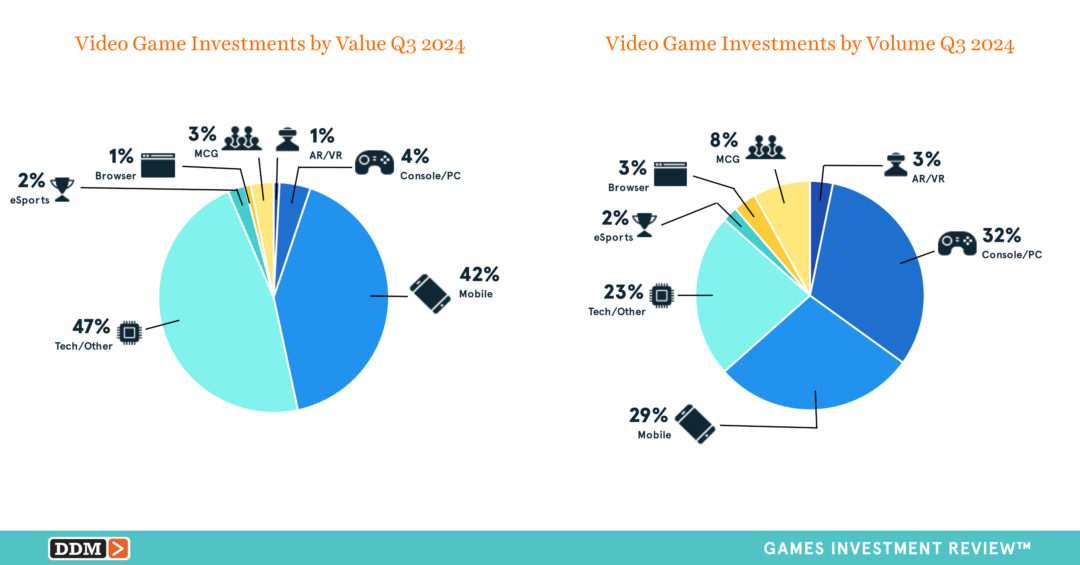

2024 YTD investments totaled $6.7B across 593 investments (+89% in value and +13% in volume over 2023’s Q1-Q3’s $3.5B over 523 investments). 2024 YTD investments now surpass 2023’s full-year investment total of $4.5B across 680 investments. Q3 2024 investments totaled $1.4B across 186 investments (-54% in value and -15% in volume compared to Q2’s $3.0B and 219 investments). While this is a substantial decline in value and volume, the investment value is still larger than any quarter from 2023 and the volume is still substantially above 2020’s average of 127 investments per quarter. Industry segments by value and volume:

M&As

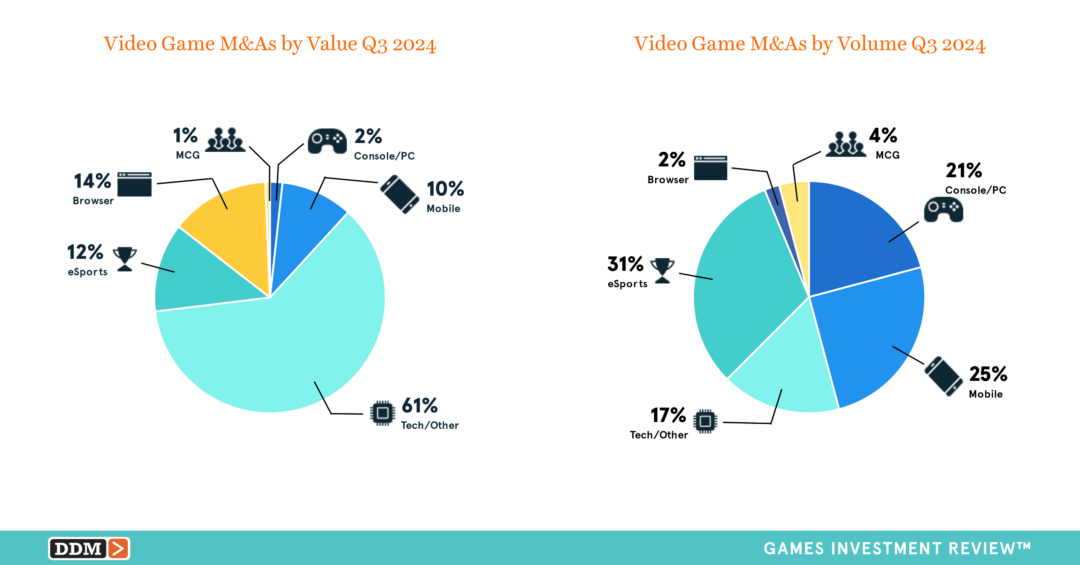

2024 YTD M&As totaled $3.7B across 133 transactions (-46% in value and +22% in volume over 2023’s Q1-Q3’s $6.8B over 109 transactions). While volume increased, the large decrease in value can be attributed to the lack of an M&A deal that is large-scale like Scopely’s $4.9B acquisition in 2023’s Q1-Q3 (71% of the M&A value).

Q3 2024 M&As marked a third consecutive quarter of declined values totaling $751.0M across 48 transactions (-12% in value and +12% in volume compared to Q2’s $852.7M across 43 transactions). Although values have been declining since Q1, the opposite is true for volume as volume has slightly increased quarter-over-quarter since Q1 2024’s 42 transactions. Industry segments by value and volume:

New Fund Announcements

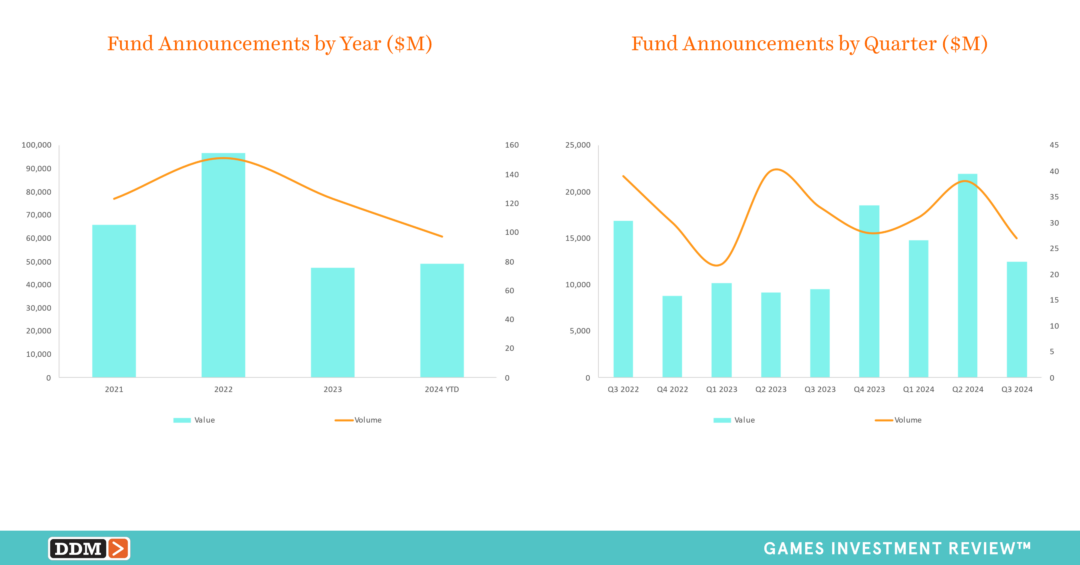

2024 YTD in new fund announcements totaled $49.1B across 97 funds (+70% in value and +2% in volume over 2023’s Q1-Q3’s $29.0B over 95 new fund announcements). While volume remains constant, fund managers are having an easier time raising capital as 2024 YTD has already exceeded 2023’s full-year fund announcement value of $47.3B.

Q3 2024 new fund announcements were propped by four funds raising over $1.2B each (79% of the capital raised) enabling Q3 2024 to reach $12.5B across 27 funds (-43% in value and -29% in volume compared to Q2 2024’s $21.9B across 38 funds). New fund announcements by value and volume:

Read more in our Q3 2024 Games Investment Executive Summary or purchase the Transaction Bundle for $399, which contains the full listing of investments, M&As, and IPOs from the quarter in a PDF and Excel file format. We have greatly expanded the content within developers, blockchain, and industry segments by releasing individual content drops throughout the year. These drops and additional data charts from our Games Investment Review reports can also be found on our website at DDMGamesInvestmentReview.com. We always welcome your feedback at data@ddmagents.com. Follow us at Digital Development Management on LinkedIn for our additional insights or sign up for our newsletter on our website.