Console/PC Games Investment Report

2023’s $69.5B for Console/PC is 2x More than Last 5 Years Combined

DDM Presents the Console/PC Games Investment Report

DDM presents a retrospective look at the 2023 Console/PC segment. While it was a tough year for some segments, 2023 was a remarkable year for Console/PC as investments and M&As totaled $69.5B across 200 transactions (+612% in value and -25% in volume compared to 2022’s $9.7B across 267 transactions), marking the largest year for the Console/PC segment and was 2x larger than the last 5 years combined (2018-2022) due to Microsoft’s colossal $68.7B acquisition of Activision Blizzard. While this milestone is unprecedented, it is worth noting that without the acquisition the Console/PC segment showed signs of trouble as it would have totaled $769.2M across 199 transactions (-92% in value and -25% in volume compared to 2022’s $9.7B across 267 transactions). This is the second consecutive year of declined value and volume and would have been the lowest yearly value across the past six years.

Investments

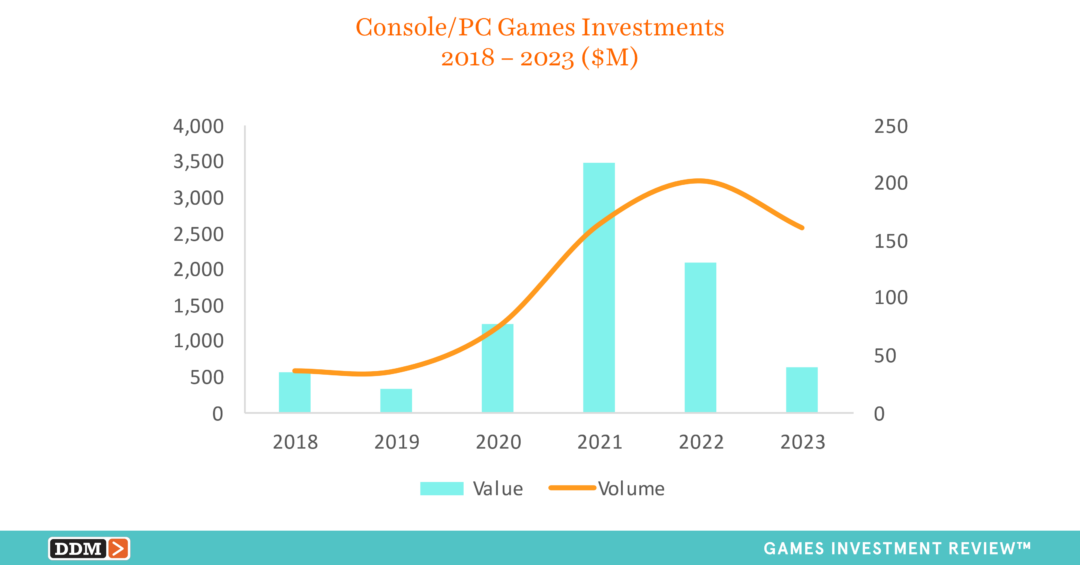

2023 Console/PC investments totaled $627.8M across 161 investments (-70% in value and -20% in volume compared to 2022’s $2.1B across 202 investments), marking the second-consecutive year of declined values since Console/PC games investment peak of $3.5B across 164 investments in 2021 when the Embracer Group raised over $1.5B across two rounds.

Mid/Late-Stage Investment Drought

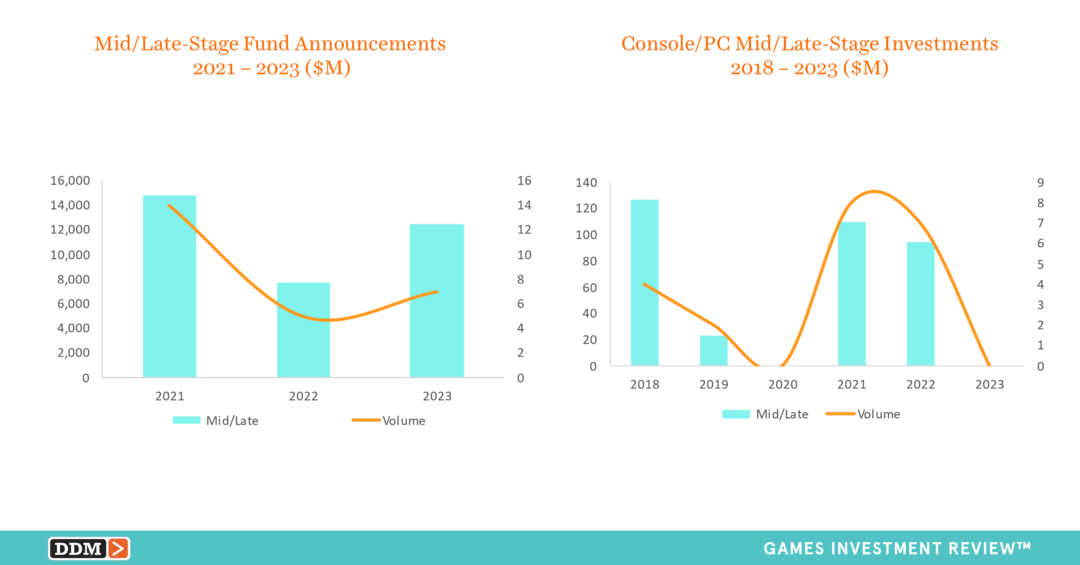

Console/PC companies with mid/late-stage rounds suffered as there were no mid/late-stage investments in 2023. Although this is not the first time the Console/PC segment received no mid/late-stage funding (2014 and 2020), it is a significant drop-off from 2022’s $94.6M across 7 investments. Since venture capital and private equity funds often create new funds which deploy capital over an extended period of time, the drought in mid/late-stage investments for the year of 2023 came after a decrease in 2022 where mid/late-stage focused fund announcements totaled $7.7B across 5 new funds (-48% in value and –64% in volume compared to 2021’s $14.8B across 14 new funds).

Exits (M&As + IPO)

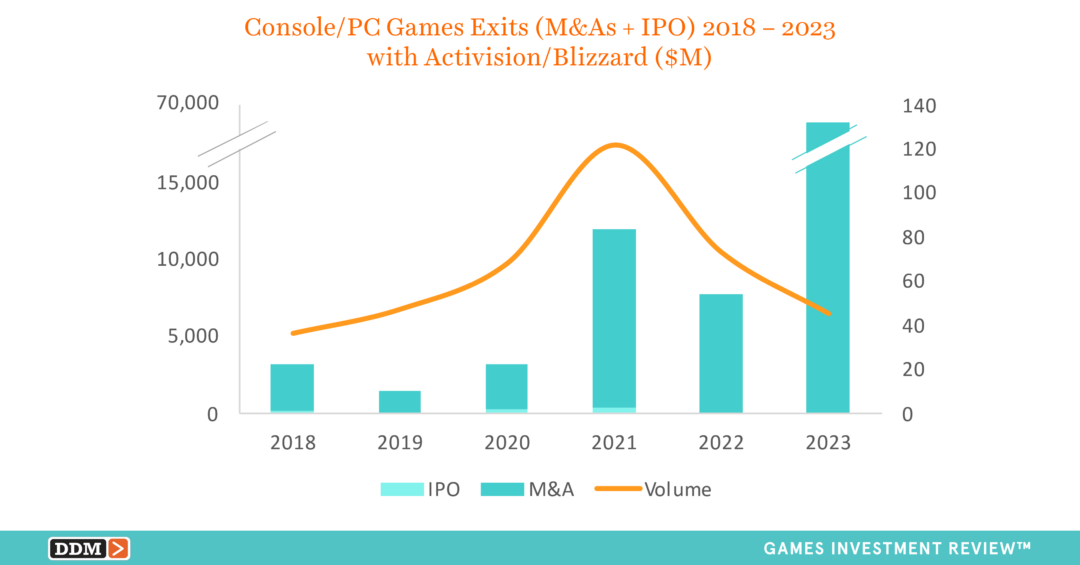

2023 Console/PC Exits (M&As + IPO) totaled $68.8B across 45 transactions (+794% in value and -38% in volume compared to 2022’s $7.7B across 73 transactions) making the exit value 2x larger than the combined total of all Console/PC exit values from 2010-2022 totaling $33.5B. Console/PC M&As for 2023 totaled $68.8B across 39 transactions (+798% in value and -40% in volume compared to 2022’s $7.7B across 65 transactions) due to Microsoft’s $68.7B acquisition which is more than 2x the combined total of all Console/PC M&A values from 2010-2022 that totaled $32.5B. Console/PC IPOs for 2023 totaled a combined $46.0M in market capitalizations across 6 IPOs (-85% in value and -25% in volume compared to 2022’s $312.8M in combined market capitalizations across 8 IP0s) marking the second-consecutive year of declined value and volume since 2021 when Devolver Digital went public with a market capitalization of $947.5M in 2021 and Console/PC IPOs peaked at $1.9B.

Exits (M&As + IPO) without Microsoft’s $68.7B Acquisition of Activision Blizzard

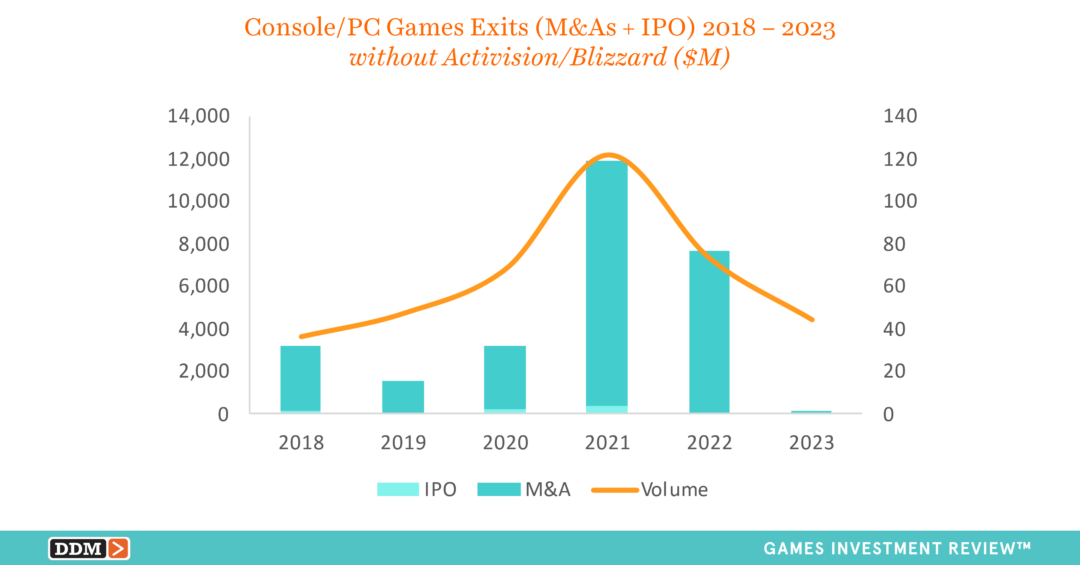

Since it was a record-breaking year for the Console/PC segment due to Microsoft’s behemoth $68.7B acquisition of Activision Blizzard, DDM performed further analyses by removing Microsoft’s $68.7B acquisition as an outlier. Console/PC Exits (M&As + IPO) for the year would have totaled $142.0M across 44 transactions (-98% in value and -40% in volume compared to 2022’s $7.7B across 73 transactions), marking the lowest yearly exit value since 2012’s $7.6M across 10 transactions. While it is a serious decline in value it’s worth noting that volume is consistent with 2019 levels of 47 transactions. Console/PC M&As for 2023 would have totaled $141.4M across 38 transactions (-98% in value and -42% in volume compared to 2022’s $7.7B across 65 transactions) marking the lowest M&A yearly value since 2012’s $7.6M across 10 transactions. Although this is an extreme decline in value, it’s worth noting that M&A volume is still above 2018 levels of 33 transactions.

Find additional topics covered in the Console/PC Games Investment Report:

- Investments and M&As by Region

- Investments and M&As by Studio Size

- 2023 Top 5 Active Investors

- Top Investments and M&As by Value 2023

- Top Investments and M&As by Value 2013 – 2023

Download the Console/PC Games Investment Report

Download our free Console/PC Games Investment Report or either standalone report the Game Developers Investment Report and the Mobile Games Investment Report. We also offer the full landscape of each quarter’s games investment and M&As in our free Games Investment Review Executive Summary as well as a paid Transaction Bundle available on our website at DDMGamesInvestmentReview.com. We always welcome your feedback at data@ddmagents.com.