DDM Games Investment Review’s Top Q3 Countries for Investments in the Gaming Space

Last month, we published our Q3 report and found the high activity in Q3 has made 2020 a record-breaking year for investments with one more quarter still to go. The total for the first three quarters of 2020 reached $9.9 billion, surpassing the previous top year of 2017’s $8.0 billion. Read more in our free report here.

We also announced special pricing for the full quarterly paid report. The report now includes a listing of all transactions for the quarter, improved charting, top listings of investors, investments, M&A activity and much more. We offer the Q3 2020 full report at a significant discount — $499 instead of the regular price of $1,499 — as a thank you to long-time Digi-Capital subscribers and welcome to our DDM friends to see the changes that we have made. Please email us at data@ddmagents.com, and we’ll send you a link to purchase.

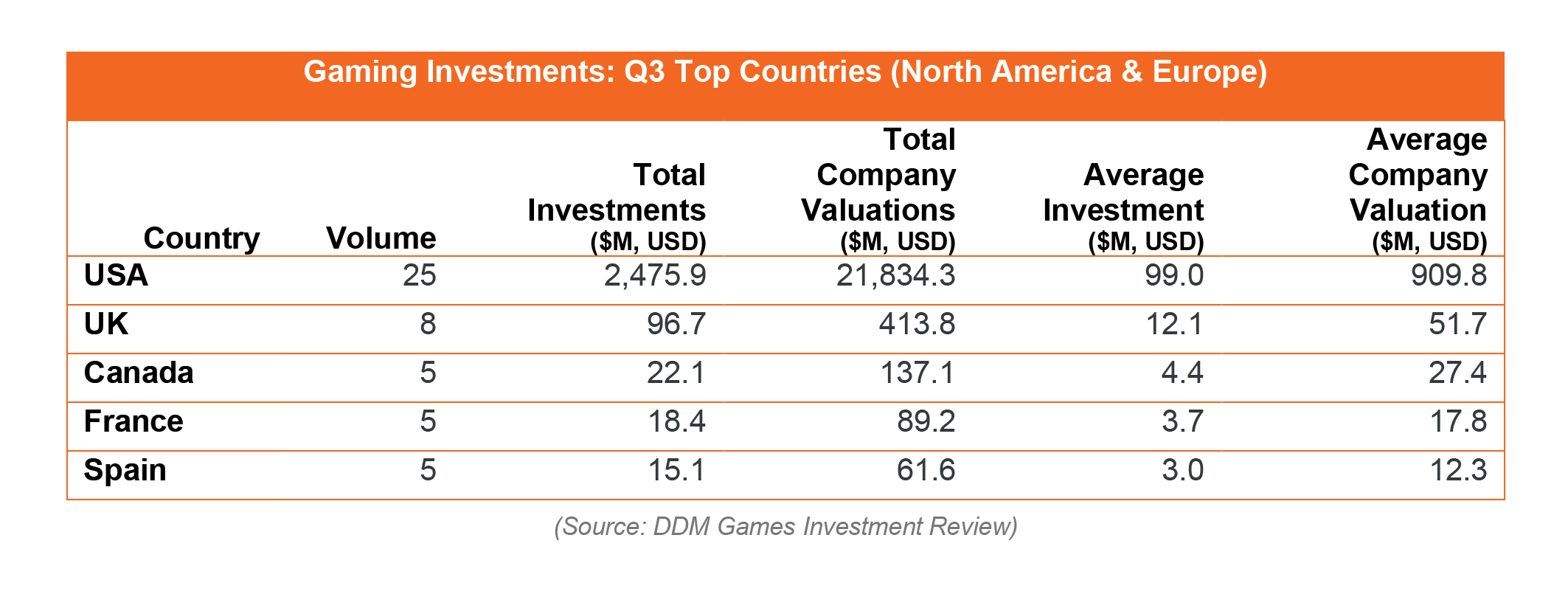

We mainly track financial investments and acquisitions that affect companies in Western markets. The United States has been the top country for investments, but we were curious to know the other active countries after that. We pulled some quick data from our Q3 tracked investments, looking at the number of deals (volume), the total and average amount of investments across all stages (from accelerator to late stage funding like Series G), as well as the total and average of company valuations.

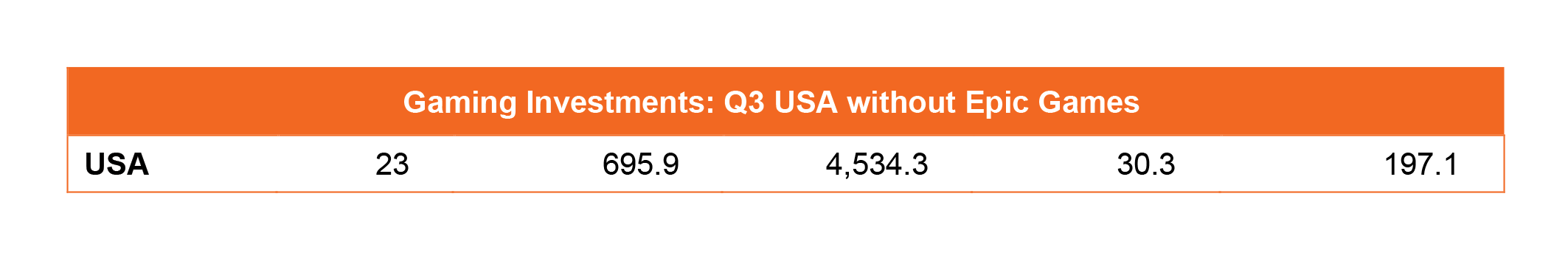

As an outlier, we removed Epic Games’ Q3 funding (below). Epic Games’ Q3 funding totaled nearly $1.8 billion (valuation of $17.3 billion), accounted for 34% of Q3’s total investments, and lifted the median size of investment in the Tech/other category from $5.6 million to $6.8 million for the quarter. After removing Epic Games, the average investment and average company valuation were 2.5x and 3.8xthe UK, respectively.

As an outlier, we removed Epic Games’ Q3 funding (below). Epic Games’ Q3 funding totaled nearly $1.8 billion (valuation of $17.3 billion), accounted for 34% of Q3’s total investments, and lifted the median size of investment in the Tech/other category from $5.6 million to $6.8 million for the quarter. After removing Epic Games, the average investment and average company valuation were 2.5x and 3.8xthe UK, respectively.

Additional notes on the data:

Additional notes on the data:

- 75 tracked investments with disclosed transactions

- Full list covered 21different countries

- Removed IPO, post-equity IPO raises, angel investments, and crowdfunded transactions

For more information on our Q3 2020 report or DDM’s Game Investment Review, visit http://www.ddmgamesinvestmentreview.com/. Follow DDM’s Games Investment Review on Twitter at @gamesinvestment.