Game Developers Annual Investment Report

Q1’s $2.0B in Developer Investments Nears 2023’s $2.3B Total Value

DDM Presents the Game Developers Annual Investment Report!

By the DDM Data and Research Team

DDM keeps an open line of communication with our customers to continuously improve our offering so our customers can level up their businesses effectively. DDM embarks on a new journey of releasing standalone reports throughout the year on the different segments of the industry, including Mobile, Console/PC, eSports, Mass Community Games, Blockchain, and AR/VR, so our customers can navigate the waters and make better decisions for their game studios.

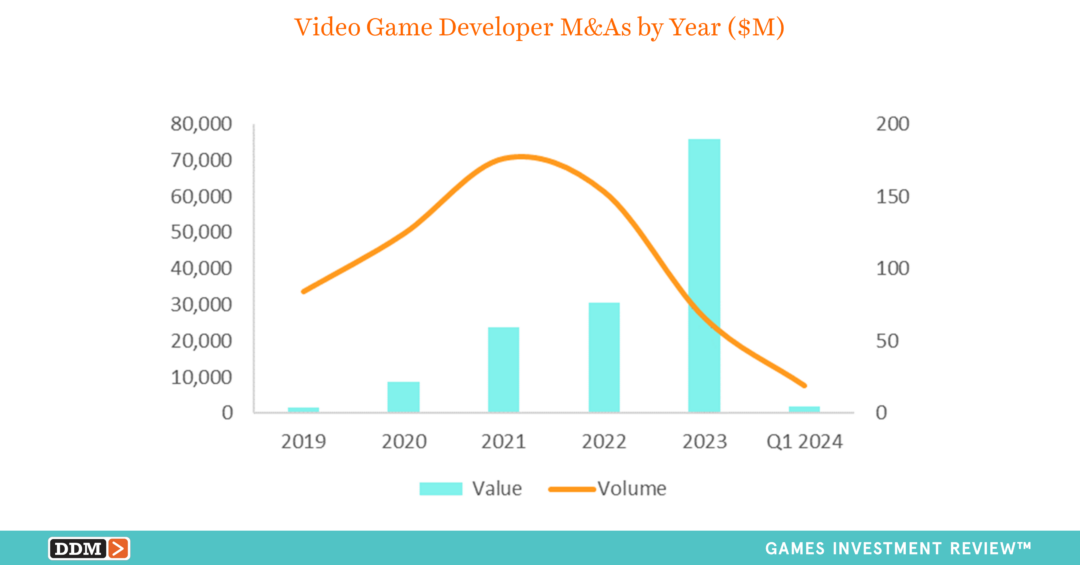

What a perfect time to release this yearly report focused on game developers. As 2023 was a tough year for investments and M&As (excluding Microsoft’s $68.7B acquisition of Activision Blizzard as an outlier), Q1 ended and 2024 is already off to a great start for games investments.

Investments

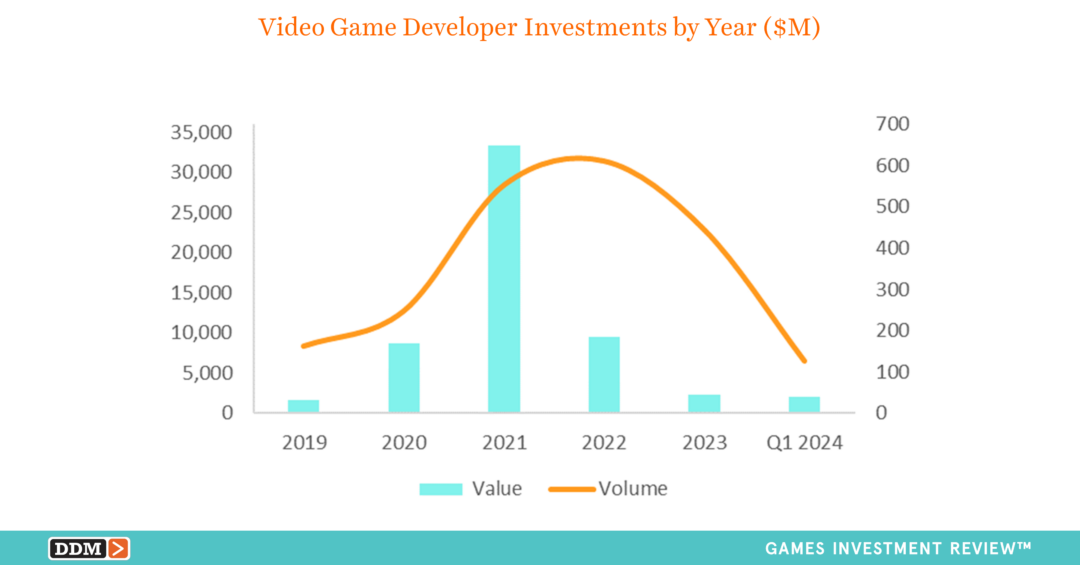

Q1 2024 developer investments totaled $2.0B across 127 investments (+308% in value and +43% in volume compared to Q4 2023’s $485.7M across 89 investments); this 4x in value is due to Disney’s $1.5B investment in Epic Games (76% of the quarter’s value) making developer investments near 2023’s yearly developer total all within the first quarter. Because of 2024’s strong start, 2024 will surpass 2023’s developer investments which reached $2.3B across 444 investments, breaking a four-year decline of investment value dating back to 2021’s peak of $33.3B across 552 investments.

M&As Q1 2024 developer M&As totaled $1.8B across 19 transactions (-97% in value and +6% in volume compared to Q4 2023’s $69.1B across 18 transactions); by excluding Microsoft/Activision Blizzard, Q1 developer M&As was +350% in value and +12% in volume compared to Q4’s $405.0M across 17 transactions. 2023 M&A value for developers achieved record highs totaling $75.7B across 66 transactions (+149% in value and -57% in volume compared to 2022’s $30.5B across 153 transactions); this 2x in value is due to Microsoft’s $68.7B acquisition of Activision Blizzard (91% of the annual value). By excluding Microsoft/Activision Blizzard as an outlier, 2023 developer M&A would have equaled $7.0B across 65 transactions (-77% in value and -58% in volume from 2022’s $30.5B and 153 deals).

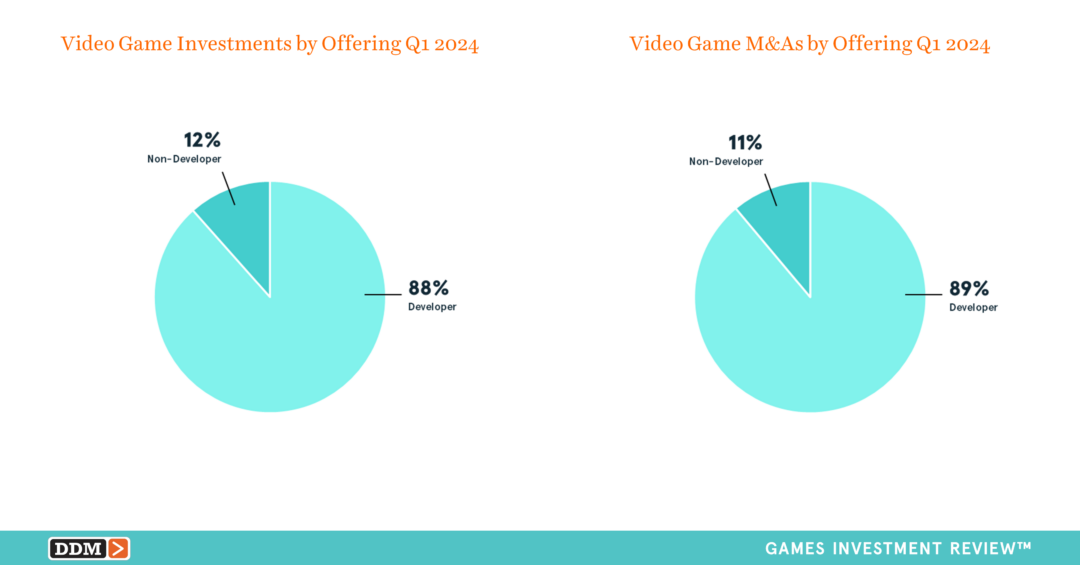

Developers vs Non-Developers

In-line with prior reports, investors and acquirers preferred game developers in Q1 2024, as developer investments and M&As totaled $3.8B across 146 transactions (+681% in value and +100% in volume compared to non-developers totaling $487.0M across 73 transactions). Q1 2024 investments totaled $2.2B across 178 investments which included developer investments that totaled $2.0B across 127 investments (88% of the value and 71% of the volume) compared to non-developers totaling $259.2M across 51 investments (12% of the value and 29% of the volume). Q1 2024 M&As totaled $2.0B across 41 transactions, including developer M&As that totaled $1.8B across 19 transactions (representing 89% of the value and 46% of the volume) compared to non-developers totaling $227.7M across 22 transactions (representing 11% of the value and 54% of the volume).

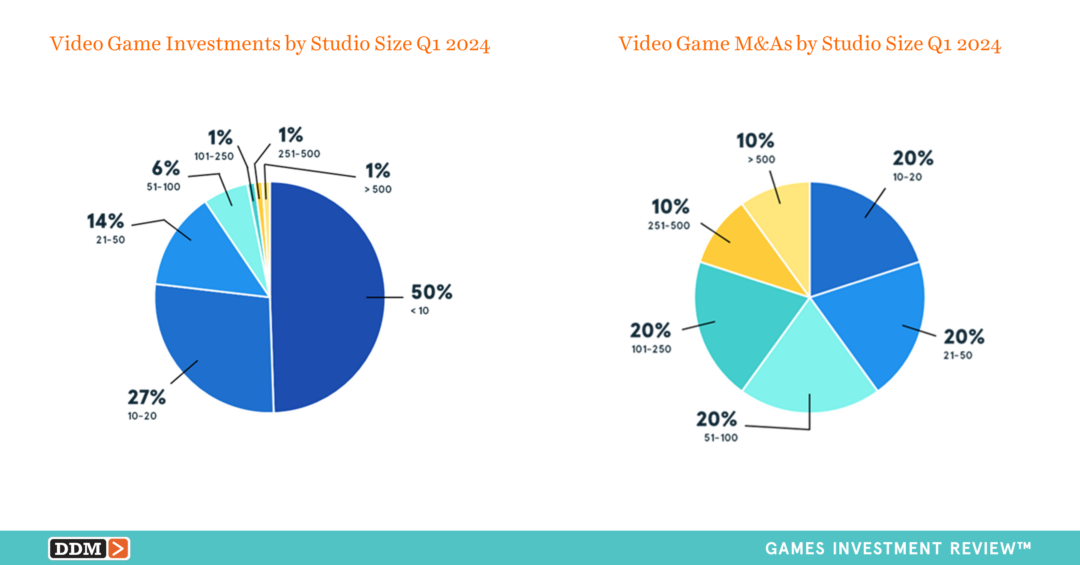

Studio Size

Investors and acquirers are targeting small to above average sized game development studios who have less than 100 employees. To distinguish between the two, investors focus on small studios (77% with 20 or fewer employees), while acquirers target studios who are slightly above average in size or smaller (60% with 100 or fewer employees).

Download the Game Developers Annual Investment Report

Download our free Game Developers Annual Investment Report. We also offer the full landscape of each quarter’s games investment and M&As in our free Games Investment Review Executive Summary as well as a paid Transaction Bundle available on our website at DDMGamesInvestmentReview.com. We always welcome your feedback at data@ddmagents.com.