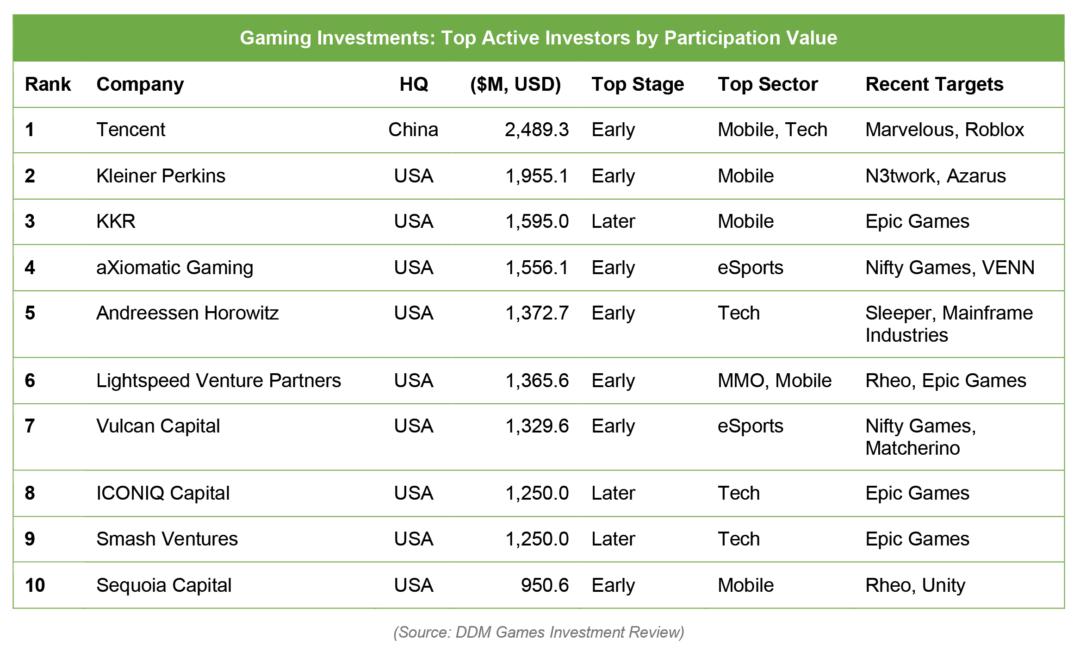

DDM Games Investment Review’s Top Active Investors by Participation Value in the Gaming Space

As a follow-up to last month’s Top Active Investors by Volume in the Gaming Space, we looked at firms by the value of rounds in which they participated.

These VC firms are mainly based in the United States and lean heavily into early stage funding (Series A or earlier) in mobile or gaming technology development. Recent targets are companies that received investment through 1H 2020 from the VC firm or a subsidiary.

Investments by Deal Values

This is a list by the sum of disclosed transactions in which the company participated. Thus, this is not a list of how much each company has invested since rarely funding round announcements break down a firm’s contribution.

Participation in one large round affects the top active investors by deal values as demonstrated by ICONIQ Capital and Smash Ventures from their participation in Epic Games’ 2018 $1.25 billion raise.

A few notes on the list:

- 10+ years of data (2006 to Q2 2020)

- These are investments and not M&A

- Our data focuses on deals done in the West, though the funders themselves may be from anywhere

- Excluded are 7% of the investments that did not publicly announce the investor(s)

After 2020 concludes, we will revisit these lists and update them with a focus on the past year. If you have feedback on the types of reports you would like to see, we welcome the input—please drop us a note at data@ddmagents.com.