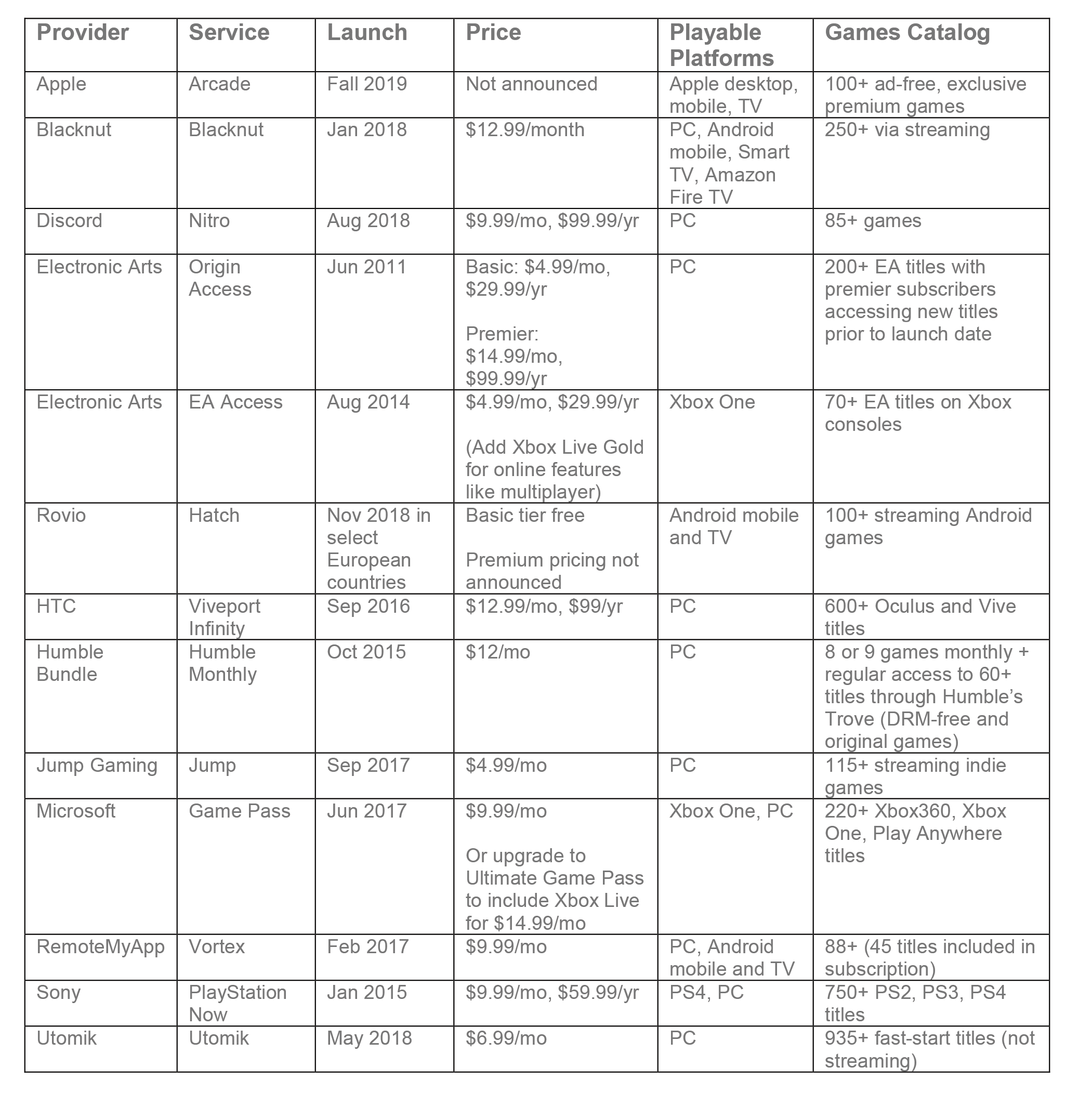

Gaming Subscription Plans

The storefront wars are heating up, resulting in a race to gain an edge on the competition through diversified means. One trend we are seeing is the rise of more gaming subscription services that often offer access to an ongoing gaming catalog for a monthly fee, a.k.a. the “Netflix of gaming” model. Several major companies, as well as niche providers, now offer monthly plans, mainly to access PC catalogs at price points below $10 a month. Apple is focusing attention on the subscription model for its platforms on desktop, TV and mobile via its newly announced exclusive service, Arcade. Here’s a quick sampling of gaming subscription plans currently available or announced.

Services expected to offer gaming subscription plans potentially include:

- Amazon—it was reported in January of this year that Amazon would develop its own game streaming subscription service, but no official news has been released.

- Google—Stadia, Google’s streaming games service announced in October 2018, is expected later this year. Its business model has not yet been revealed.

- Nvidia—GeForce NOW is Nvidia’s streaming service for PC and Shield TV and is currently in beta with a limited number of games available to Shield TV players; it is another service that could offer a subscription model, but which has not yet been announced.

- Verizon—Verizon Gaming is a streaming game service that was tested on Nvidia Shield devices in January and is expected to also become available on Android devices but is still in early stages and seems positioned for 5G networks.

Microsoft recently underscored the trend towards subscription pricing—gamers are acting more like subscribers than one-time purchasers as they are playing longer, spending more and discovering games well after launch. Ovum reported consumers typically subscribe to 2.25 SVOD services like Netflix, Amazon and Hulu, which may be satisfying to consumers since a large volume of TV and movie content can be captured in a few SVOD services. However, the volume of games released and the multitude of sales and distribution channels is much greater and we are curious if subscription services will be similarly consolidated. As the storefront wars accelerate, we will watch these services and more to see who will win over consumers with the right mix of pricing, content and convenience.