Next-Gen Console Wars Show the Platforms are Alive and Well

The biggest splash in the next-gen console war to date wasn’t the recent pricing and launch dates from Microsoft and Sony for their Xbox Series X/S and PlayStation 5 and Digital Edition consoles. It was Microsoft purchasing ZeniMax Media, the privately-held parent company of publisher/developer behemoth Bethesda, for $7.5 billion in cash.

With the transaction expected to be finalized in the first half of 2021 (Microsoft’s second half of fiscal year), Microsoft will grow its family of development studios from 15 to 23 and add 2,300 employees from Bethesda.

This is a union with strong benefits to both parties:

- Bethesda is best known for its games on console and PC; Microsoft’s strengths as well.

- Microsoft gains tentpole video game IPs from Bethesda: The Elder Scrolls, Fallout, DOOM, Quake, Wolfenstein, and Dishonored, and closes the gap on the breadth of AAA titles from Sony while increasing the value of its Xbox Game Pass subscription.

- Bethesda gains access to Microsoft’s gaming technology that includes backend infrastructure and cloud streaming, allowing Bethesda to further focus on game development.

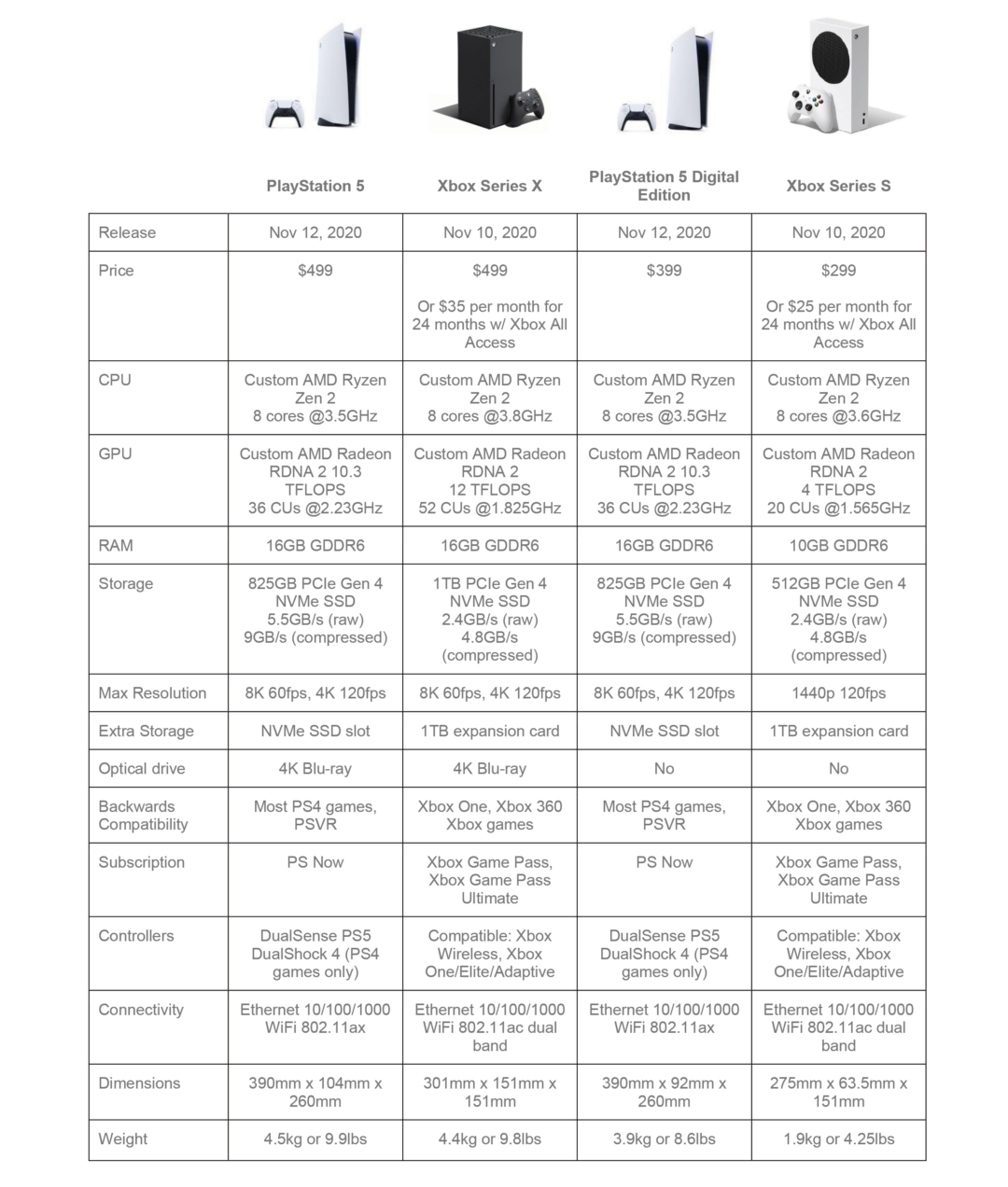

From a technical standpoint, the leading consoles, Xbox Series X and the PlayStation 5, are similar, with the Xbox Series X edging out the PlayStation 5 on graphical performance. Sony has a significant technical edge among the competing digital-only consoles as its PlayStation 5 Digital Edition is essentially the same as its flagship console minus the Blu-ray drive. Microsoft seems to be betting that mainstream, budget-conscious consumers may not mind the lower graphical, storage, and resolution capabilities of its Xbox Series S as its console has the lowest price at $299. This is the first console cycle where a more mainstream-friendly device has been launched alongside the robust flagship console.

Here’s a quick comparison of the four models’ technical specs:

Going into this console cycle, Sony’s PlayStation has a substantial edge on the device userbase. Microsoft stopped reporting console sales, but it is estimated that PlayStation 4 has outsold the Xbox by 2:1. Ampere analyst, Piers Harding-Rolls, estimated the installed base of all PS4 models at 108 million and Xbox One at 49 million at the end of Q1.i Undoubtedly, that momentum will spill into the next-gen cycle.

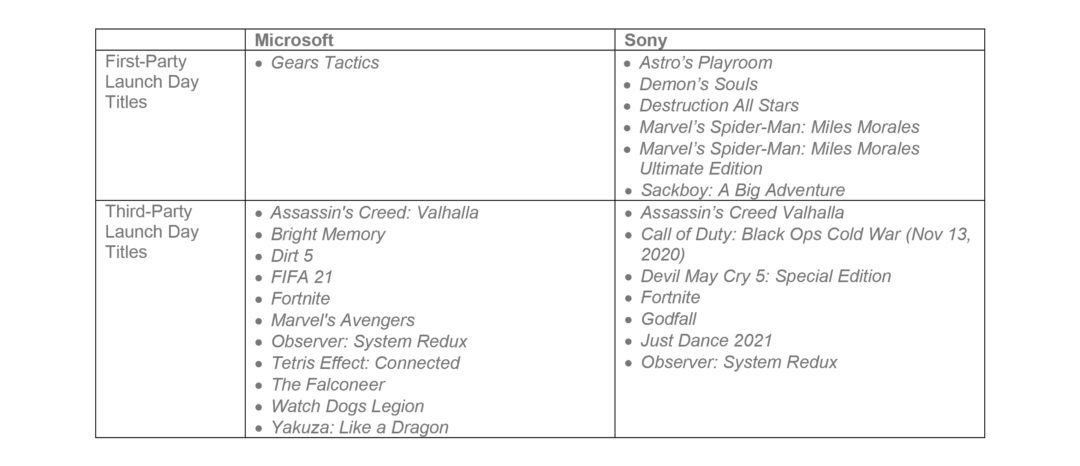

Traditionally, console launches have exclusive games only available for that specific device to help drive sales. This cycle, the term “exclusive” has become muddied with it being used to describe games released on the flagship consoles as well as older devices, a sign that neither manufacturer is using the traditional console exclusive titles as a primary motivator for early-adopter sales. Though Sony has announced their own release titles for the PS5, titles such as Marvel’s Spider-Man: Miles Morales and Sackboy: A Big Adventure are also available on the PS4 console. With an even further dilution of the term exclusive, Microsoft’s own titles are largely available on PC and all will work on the current Xbox One console.

With a disadvantage in device sales, Microsoft has innovated on its monetization strategy, introducing its Xbox Game Pass subscription at $9.99/month in 2017 and expanding its benefits to include first-party releases day-and-date. It has since added a tiered Ultimate plan of $14.99/month that includes its Xbox Live subscription for multiplayer gameplay, use with Android devices, recently announced beta access to its xCloud streaming games service, and inclusion of Electronic Arts’ subscription service EA Play. Back in April, Microsoft announced it had 10 million Game Pass subscribers. With the announcement of the Xbox Series X release date and pricing, Microsoft said its Game Pass subscribers had crossed 15 million.

Microsoft has additionally innovated its monetization strategy by introducing installment plans for its consoles, another milestone for a console launch. Much like purchasing a smart phone and spreading the cost over two years, Microsoft is offering the Xbox All Access plan that includes its Xbox Game Pass Ultimate subscription and one of its devices for a monthly fee for 24 months: $24.99/month for the Xbox Series S and $34.99/month for the Xbox Series X.

While the acquisition of Bethesda is too close to the console launch to capitalize on exclusive games, the long-term payoff will be including past and future Bethesda games in the Xbox Game Pass subscription. Microsoft has emphasized “empowering people to play the games they want, with the people they want, anywhere they want”ii and their emphasis on growing its services with the Xbox Game Pass subscription is a testament to that. It may not matter if Bethesda’s games are exclusive to Microsoft as much as they are simply included in the Xbox Game Pass, further driving its value proposition.

Already possessing a much-lauded AAA first-party games portfolio, it is fitting that Sony’s recent investment is in technology. Though Sony has had a long lead time to develop its service offerings, it has been trailing Microsoft’s initiative. Sony acquired streaming companies Gaikai and OnLive (2012 and 2015, respectively) and launched its own streaming subscription service PlayStation Now in 2014. However, it was largely quiet on that front until 2019 when Sony announced it was collaborating with Microsoft on cloud solutions. In contrast to Microsoft’s 10 million Game Pass subscribers announced in April, Sony reported in May its PlayStation Now subscription had 2.2 million subscribers. In comparison to Microsoft’s most recent acquisition of Bethesda, Sony’s investment was to acquire a 1.4% minority stake in Epic Games, the developer behind Fortnite but also the Unreal Engine. Announced in July for $250 million, the deal may help Sony improve its services since the deal will “broaden their collaboration across Sony’s leading portfolio of entertainment assets and technology, and Epic’s social entertainment platform and digital ecosystem to create unique experiences for consumers and creators.”iii

Analysts and commentators had already christened Sony as the winner of the next-gen console based on its install-base and gaming IP strengths. Though there have been reports that there were fewer PlayStation 5 Digital Edition consoles available, pre-orders for all of the systems sold out on their first day demonstrating strong interest across both lines. It should also be mentioned that while Sony and Microsoft wage this battle, Nintendo’s Switch continues its extremely impressive performance with an install base of over 61M units as of June 2020 and exclusive IP that are the envy of the industry.iv The great news is that the death of consoles as commented over the past several years with the acceleration of digital distribution had been greatly exaggerated. Microsoft’s acquisition of ZeniMax Media has injected additional excitement in this upcoming cycle and the console war has moved beyond comparisons of device sales.

i Harding-Rolls, Piers. “Next-generation games consoles.” Ampere Analysis, June 2020.

ii Hines, Pete. “Why Microsoft is the Perfect Fit.” Bethesda, September 2020.

iii Sony. “Epic Games Receives Strategic Investment from Sony Corporation.” July 2020.

iv “Dedicated Video Game Sales Units.” Nintendo, June 30, 3020.