Q3’s $8.7B Investments/M&As Shows 2022 Slowing Down but 2022 Remains a Solid Year

Q3 2022 Games Investment Review Report Available

By the DDM Data & Research Team

As a refresher, we witnessed a record year in 2021 where the video games industry achieved “a rising tide lifts all boats” effect with unprecedented revenues and profits that fueled investments, acquisitions, and IPOs:

- Investments from 2020 to 2021 more-than tripled in value ($13.5 billion to $40.7 billion) and doubled in volume (487 to 843)

- M&As also more-than tripled in value ($12.0 billion to $40.9 billion) and nearly reached 1.5x in volume (233 to 336)

- IPOs outpaced both investments and M&As by tripling volume (10 to 34) and increased 5x in value ($20.6 billion to $109.0 billion in total market capitalization)

In contrast to the record-breaking last year, 2022 has already seen a crypto winter, macroeconomic headwinds from the Ukraine war, high interest rates and inflation, and recession concerns that have darkened the investment landscape and continued throughout Q3. Despite these challenges, our data shows that 2022 has already been a solid year even with a pullback in comparison to 2021:

- So far in 2022 (Q1 through Q3) investments have reached $10.7 billion over 708 transactions, and based on our 13+ years of data, if Q4 reaches the historic average of $1.5 billion, DDM estimates 2022 will be the third highest year ever recorded

- M&As have reached $33.3 billion, already surpassing every previous year with exception to last year’s record-breaking $40.9 billion

- Eight companies have gone public resulting in the third highest year

- Combined value of investments and M&As for 2022 year-to-date at $44.0 billion is a 46% decrease in comparison to 2021’s $81.6 billion

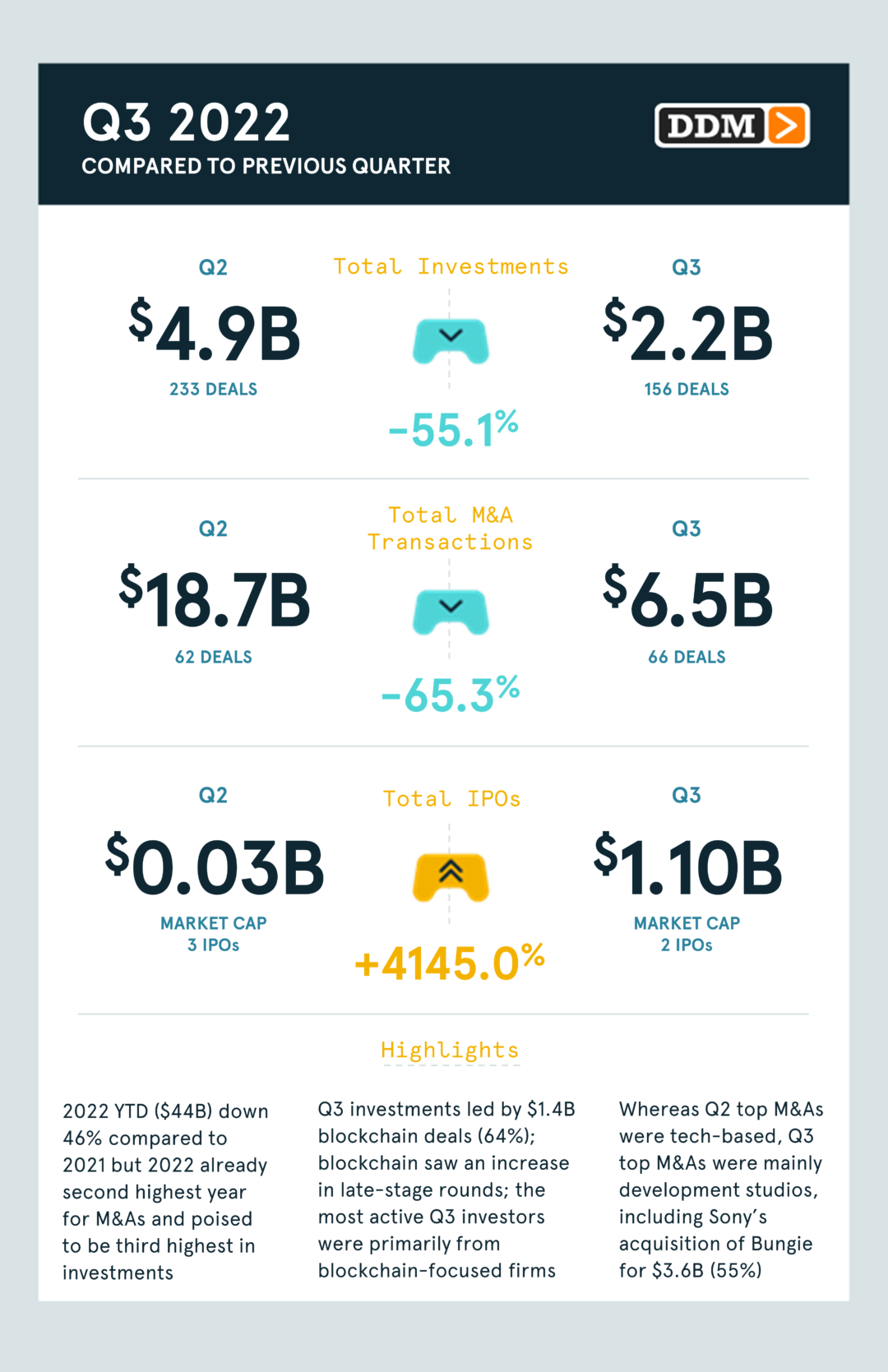

Disclosed investments for the quarter amounted to $2.2 billion across 156 investments, a decrease of 55% in value and a decrease of 33% in volume over Q2. A decline in quarterly values since Q1 means Q3 is the lowest in value and volume since Q4 2020. Sony’s $3.6 billion acquisition of leading games developer Bungie represented 55% of the Q3’s $6.5 billion value across 66 mergers & acquisitions transactions. While the volume of M&As increased 6.5%, the quarterly value declined 65% from Q2. Q3 continues the pre-pandemic quarterly trend with 2 IPOs while market capitalizations are highest since Q4 2021 due to Technicolor Creative Studios’ public debut with a $1.0 billion market capitalization.

To continue reading our free Q3 2022 report, click here.

—

The DDM Games Investment Review Q3 2022 report is now available for purchase: $399 per single quarter or $999 for an annual subscription. In addition to our industry forecast, the report contains a complete list of investment/M&A transactions from the quarter as well as expanded lists of the quarter’s top transactions and investors. For more information about our quarterly reports or the DDM Games Investment Review, visit www.ddmgamesinvestmentreview.com or email data@ddmagents.com.

Follow the DDM Games Investment Review on Twitter at @gamesinvestment.